The announced merger of Dow Chemical and DuPont has the chemical industry abuzz and it leads to the question on the future of DuPont’s industrial bioscience business, which will be under the Specialty Products business of the merged companies.

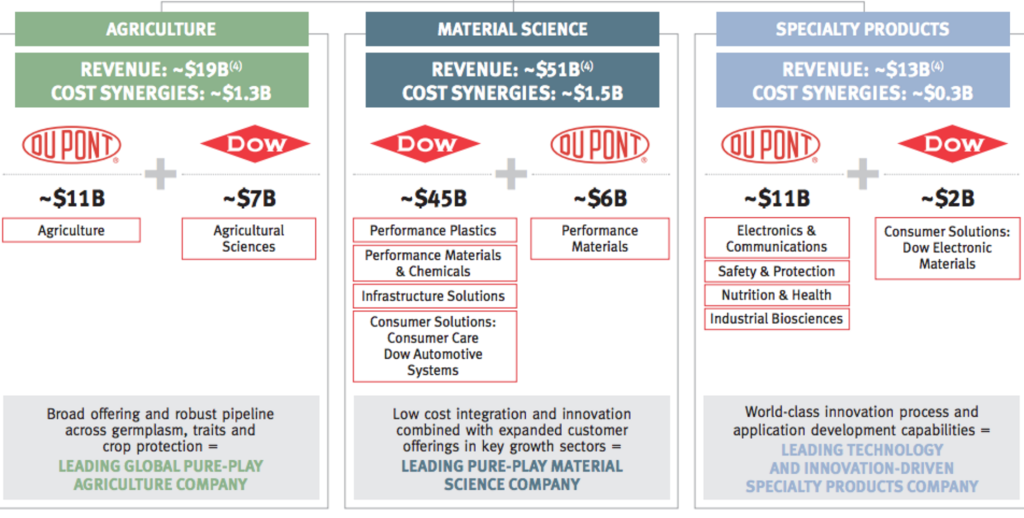

The $130 billion combined company called DowDuPont intends to subsequently pursue its separation into three independent publicly traded companies through tax-free spin-offs, which could occur within 18-24 months following the closing of the merger. The companies will include the ff:

- Pure-play Agriculture company with the combination of DuPont Pioneer and Dow Agroscience

- Pure-play Material Science company

- Specialty Products company

The transaction is reportedly expected to deliver around $3 billion in cost synergies, with 100% of the run-rate cost synergies achieved within the first 24 months following the closing of the transaction. Additional upside of around $1 billion is expected from growth synergies.

Upon completion, Andrew Liveris of Dow Chemical will become executive chairman of the newly formed DowDuPont Board of Directors, while Edward Breen of DuPont will become the CEO of DowDuPont. The new company will be dual headquartered in Midland, Michigan, and Wilmington, Delaware.

Dow employs around 53,000 workers worldwide and DuPont employs around 63,000. Approximately 10% of DuPont’s global workforce will be impacted.

More analysis of this merger and the potential effects in DuPont’s industrial bioscience business on Tecnon OrbiChem’s December Bio-Materials newsletter.

In the meantime, let me also post this announcement last month from Joule and Red Rock Biofuels on their merger. Red Rock Biofuels’ technology leverages Fischer-Tropsch to convert biomass residues from forests and sawmills into jet fuel and diesel products. Joule has developed a direct CO2-to-fuel production platform via algae and solar energy.

Red Rock Biofuels is planning to build its first biorefinery in Lakeview, Oregaon, which will start construction in early 2016. The project is supported by a $70 million grant from the USDA, Navy and US DOE. The company has entered an off-take agreements with Southwest Airlines and FedEx for the fuel that will be produced.

FOLLOW ME ON THESE SPACE

Discussion

Comments are closed.