It has been a long time since anybody heard from Cobalt Technologies and my last post about it was in 2013. I read this interesting news from butanol experts, Sam Nejame and James Evangelow, who posted on Biofuel Digest about the demise of n-butanol tech developer, Cobalt Technologies.

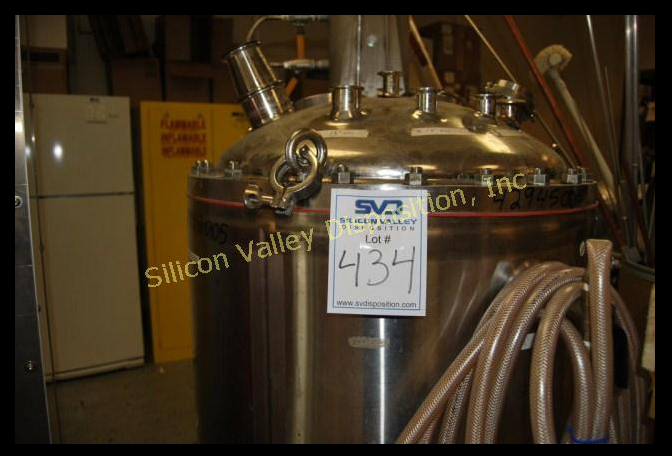

In May, Silicon Valley Disposition announced that it has ran an online auction of all physical assets of Cobalt Technologies in Mountain View, California. It is not known who is acquiring the company’s IP technologies. Cobalt Technologies was founded in 2008 as a start-up that specialized in developing bio-based n-butanol using cellulosic feedstock such as corncobs, wood waste and pine trees. The company’s technology converts both C5 and C6 sugars into n-butanol and had a pilot facility with a fermentation scale of around 4,000 liters. Cobalt Technologies had previous partnerships and collaborations with ANDRITZ Inc., Solvay/GranBio, Bunge and the US Navy (for production of jet fuel from n-butanol).

The bio-butanol sector has certainly seen a lot of shake-out: Green Biologics merging with Butylfuel, Butalco acquired by Lesaffre, Elekeiroz acquiring the technology rights on Coskata’s bio-butanol production processes, and Cathay Industrial Biotech abandoned its IPO plans and currently also idled its bio-butanol production in China. Bio-isobutanol producer, Gevo, is on a watch-list as the company has been operating at low cash on hand these past several quarters.

It seems M&As, buyouts and dropouts are now becoming the norm in the renewable chemicals industry as technologies become more mature and financing more scarce. The blog is currently working on a media partnership with INFOCAST for its upcoming ‘Sustainable Chemicals & Plastics Adoption & Application Summit‘ that will be held in September, and some of the panel discussions will be focusing on financing and M&As. The recent subpar performances in the public markets have certainly scared companies in even entering IPOs, and as a result, many have now been seeking other commercialization strategies such as JVs and M&As.

Some examples that were cited included Stora Enso’s purchase of Virdia, REG’s acquisition of LS9, and Trellis Earth’s procurement of Cereplast. There are also Verenium acquired by BASF, Evolva acquired Allylix, Cardia Bioplastics merged with Stellar Films, Givaudan acquired Soliance, and Renmatix acquiring the assets of former Mascoma Corp. Speaking of former companies, recent exits aside from Cobalt Technologies also included OPX Biotechnologies, TMO Renewables, Kior and Range Fuels. Codexis, meanwhile, has changed its tune and went back to focusing in the pharmaceutical market.

FOLLOW ME ON THESE SPACE

Tetravitae Biosciences, a spin from Dr. Blaschek’s lab in UIUC, seems to be the most successful in the biobutanol area then. They started in 2007, demonstrated in 2010 and got acquired by Eastman Chemicals in 2011.

Posted by Aniket Kale | July 12, 2015, 7:51 amEastman acquired the technology but put it storage. They have no immediate plans to practice it. The entire renewables sector is being challenged by low energy and petrochemical prices which should decline further now that Iran will be allowed to export. Expect to see more renewable players without deep pockets drop out. The Europeans take “green” more seriously and may be better able to ride it out. However, over the long term, petro prices will rise so we will see a weeding out and the “survival of the fittest”.

Posted by James Evangelow, Chemical Strategies | July 16, 2015, 1:26 pmJames,

Thanks for the comment. Gevo is the one I have been following quite closely on the isobutanol front. Their balance sheet is quite worrying but hopefully they’ll be able to pull through.

Posted by Doris de Guzman | July 17, 2015, 2:18 pm