I just finished listening to the conference call of this unexpected news about US biodiesel company, Renewable Energy Group (REG), acquiring LS9 for a purchase price of up to $61.5 million in stock and cash. Perhaps, this news could be the signal of further consolidation within the renewable chemicals industry?

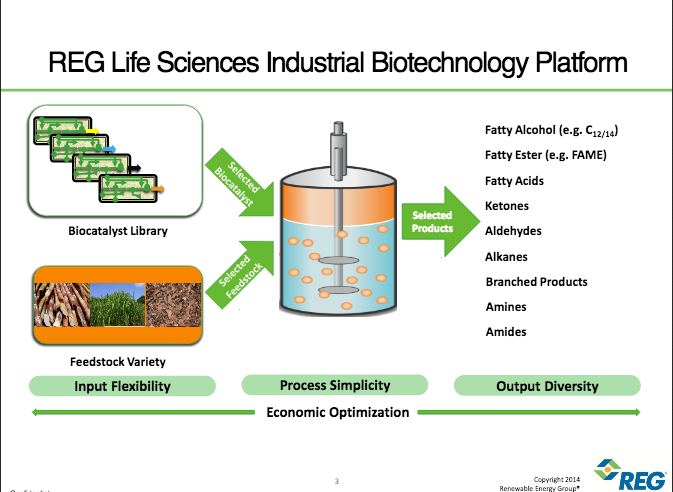

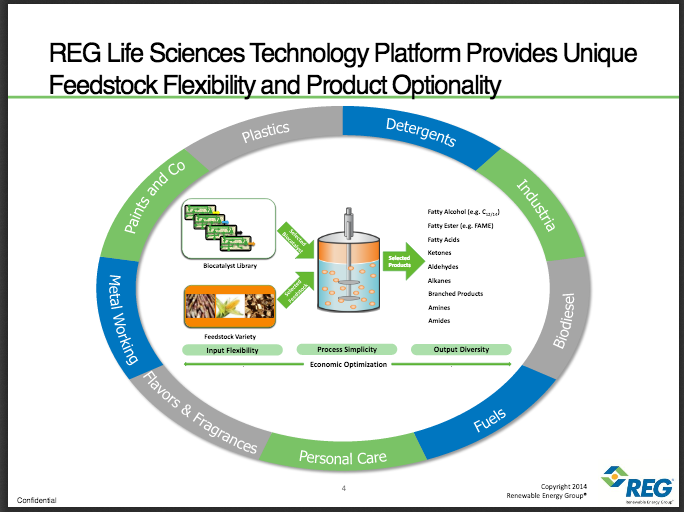

REG plans to expand into the production of renewable chemicals via industrial biotechnology with this acquisition. According to the company, the acquisition will be the cornerstone investment for its new business platform, REG Life Sciences, which also plans to develop adjacent and complementary fermentation technologies.

Most of the LS9 team (about 30-35), including the entire R&D leadership group, will join the newly named REG Life Sciences, LLC, which will operate out of LS9’s headquarters in South San Francisco, CA. I was late joining the conference call so I am not sure if LS9’s current CEO Tjerk de Ruiter will lead the new business given its background as the last CEO of biotech company Genencor before DuPont bought it in 2011.

“This acquisition is a major step in realizing REG’s strategy to expand into the production of renewable chemicals and other products,” said Daniel J. Oh, Renewable Energy Group President and CEO. “The industrial biotechnology platform and robust patent portfolio LS9 has been building will now be combined with REG’s proven production and commercialization capabilities to accelerate the commercial introduction of renewable chemicals to meet increasing customer demand for sustainable products.”

Under the terms of the agreement between REG and LS9, REG paid $15.3 million in cash and issued 2.2 million shares of REG common stock (valued at approximately $24.7 million based on a trading average for REG stock) at closing. In addition, REG may pay up to $21.5 million in cash and/or shares of REG common stock consideration for achievement of certain milestones over the next five years related to the development and commercialization of products from LS9’s technology.

In the conference call, REG officials noted its potential access to specialty and renewable chemicals market using LS9’s E.coli fermentation technology. Readers of the blog should recall that LS9 already has a 135,000 liter fermentation demonstration capacity at its Okeechobee, Florida, facility, and that the company has already been planning for commercial production of sugar-based fatty alcohols and fatty acid methyl ester (also known as biodiesel) via fermentation processes.

REG said it still plans to look for partners for the new IB business to help achieve advancement of LS9’s technology into commercial phase. The demo facility in Florida can also be turned into a production facility for smaller batch, higher-value specialty chemicals. REG expects expeditious development of LS9’s platform products within 6-24 months.

An interesting synergy between the two companies is that REG also produces crude glycerol as a byproduct of its biodiesel production, and this could be used as feedstock to produce renewable chemicals via fermentation processes. Glycerol is structurally analogous to sugar. Just think about glycerol-based acrylic acid, 1,3 propanediol (PDO), isoprene, etc. for commodity renewable chemicals. REG’s distribution and logistics capabilities will also benefit LS9 in terms of sourcing feedstock for production of fermentation-based chemicals, and marketing those renewable chemicals.

REG itself is no stranger to development of renewable chemicals. REG has (or had??) a relationship with Glycos Biotechnologies, which is developing chemicals such as ethanol, isoprene, acetone, hydrogen, 1,2 propanediol and other organic acids such as lactic acid, succinic acid and formic acid using crude glycerin as feedstock. REG has been collaborating with GlycosBio since 2007.

Since REG’s IPO in early 2012, the company has already been planning back then to expand into the renewable chemicals sector.

Another recent announcement is REG’s acquisition of Syntroleum, which is still on the works. Syntroleum has pioneered Fischer-Tropsch gas-to-liquids and renewable diesel fuel technologies and has 101 patents issued or pending. Syntroleum also owns a 50% interest in Dynamic Fuels, LLC, a 75-million gallon renewable diesel production facility in Geismar, Louisiana, which uses animal fats and greases, for feedstock. The other 50% share is owned by Tyson Foods, which supplies the feedstock for the Geismar facility.

Interestingly enough, Dynamic Fuels also has the capability of producing bio-based naphtha from its Geismar facility. Naptha is a precursor for production of various commodity and specialty chemicals. Dynamic Fuels has the technology to produce C14-C17 n-paraffins for use as industrial fluids or as intermediate for detergents (e.g. for secondary alkane sulfonate surfactants), C18 n-paraffin (octadecane) for use as phase change material, and isoparaffinic solvents for use as drilling base fluids.

REG is definitely a company to look out for in the renewable chemicals space!

FOLLOW ME ON THESE SPACE

Discussion

Comments are closed.