Deals with special purpose acquisition companies (SPAC) seem to be the favourite route these days for bio-based chemical start-ups to shorten the timeframe of the cumbersome IPO (initial public offering) process. The blog reported last month Danimer Scientific’s debut at the New York Stock Exchange after going through a similar process with Live Oak Acquisition Corp.

Origin Materials announced this week its temporary merger with Artius Acquisition Inc., a publicly-traded SPAC in order for Origin to become a public company to be listed under the new ticker symbol ORGN on the Nasdaq exchange. The transaction is expected to provide up to $925 million in gross proceeds comprised of Artius’ $725 million of cash held in trust and $200 million fully committed investments in public equity (PIPE) at $10/share from investors such as Danone, Nestlé Waters, PepsiCo, Mitsubishi Gas Chemical and AECI, as well as certain funds and accounts managed by Sylebra Capital, Senator Investment Group, Electron Capital Partners, BNP Paribas AM Energy Transition Fund and affiliates of Apollo.

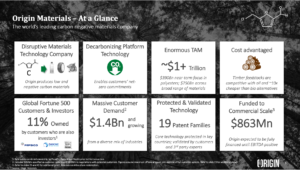

All Origin stockholders, including the current members of the NaturALL Bottle Alliance, Danone, Nestlé Waters and PepsiCo, will roll 100% of their equity holdings into the new public company. The new ORGN ownership will include 42.4% existing shareholders, 46.7% SPAC shares and 10.9% PIPE investors. The transaction, inclusive of $200Mn PIPE financing, is expected to result in $863Mn of cash to balance sheet, which is anticipated to fully fund the company’s operations and capital expenditures until EBITDA positive.

So just refreshing our readers’ memories about Origin Materials as I usually report about the company on Tecnon OrbiChem’s Bio-Materials newsletter and not much on the blog, the company has been working on the commercialization of 5-chloromethylfurfural (5-CMF) using wood cellulose feedstock — although the company emphasized that it is not limited to using wood residues for raw materials. The company is building a plant dubbed Origin 1 in Sarnia, Ontario, Canada (maybe near LCY Biosciences??), which is expected to be operating by year-end 2022. Origin Materials did not disclose the capacity of the facility.

5-CMF is a building block that can be converted to produce paraxylene, a chemical intermediate used in the manufacture of PET or even PEF, hence the interests of beverage brand owners such as Danone, Nestlé and PepsiCo. Of course, like 2,5-HMF, 5-CMF also has other broad applications outside of PET/PEF including adhesives/coatings and plasticisers. Origin Materials’ hydrothermal carbonization of biomass also produces products such as activated carbon/fuel pellets, carbon black, biochar, and other ‘high-potential carbon-negative’ platform materials.

In order to analyze more about 5-CMF, I’ll probably be asking my colleagues at Fisher International and Forest2Market about pine pulpwood feedstock which Origin Materials seems to be focusing on when comparing sugar feedstock economics. More on this will be reported in the Bio-Materials newsletter’s March issue.

FOLLOW ME ON THESE SPACE

Discussion

Comments are closed.