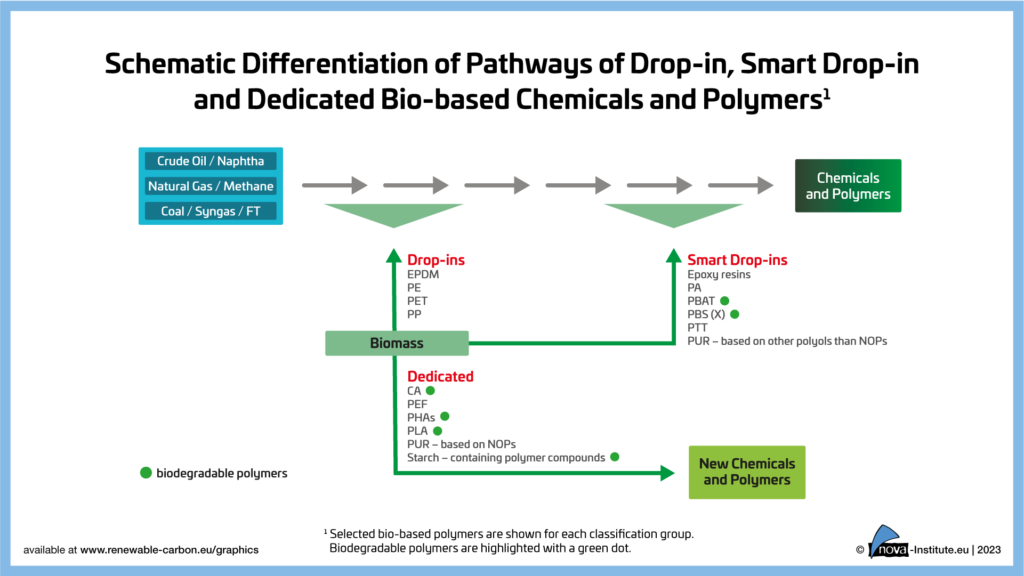

nova-Institute has finally released its latest report – “Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2022-2027” – stating a CAGR growth of 14% for bio-based polymers between 2022 and 2027. In this report, the polymers are grouped into bio-based ‘drop-in’, ‘smart drop-in’ and ‘dedicated’ inputs within the chemical production chain.

The report shows capacities and production data for 17 commercially available bio-based polymers in 2022 and a forecast to 2027. In 2022, the total installed capacity was 4.9 million tons, with an actual production volume of 4.5 million tons. Unfortunately, this is still only 1% of the total production volume of fossil-based polymers.

I actually wrote a recent profile about the polyethylene (PE) market for Tecnon OrbiChem’s Bio-Materials report, and as of 2022, the total global PE capacity is roughly estimated at around 216 million tons, while ethanol-based PE, all produced by Braskem, is only 260 ktpa. Braskem, by the way, is aiming to reach 1 million tons of green PE production capacity by 2030. Production of ethylene sourced from other renewable feedstock (CO2, pyrolysis oil, bio-naphtha, waste fats/oil) is also starting to increase worldwide.

Bio-based polymers capacity is expected to increase to 9.3 million tons in 2027 indicating an average compound annual growth rate (CAGR) of around 14%, which is significantly higher than the average overall growth polymers of 3-4%. Biopolymers such as polyhydroxyalkanoates (PHAs) is expected to have a CAGR of 45%, polylactic acid (PLA) with 39%, polyamides (PA) with 37% and polypropylene (PP) with 34%. PE in Europe will reportedly increase by 18% until 2027. Casein polymers (which, unfortunately, I do not follow as much will reportedly increase by 15%.

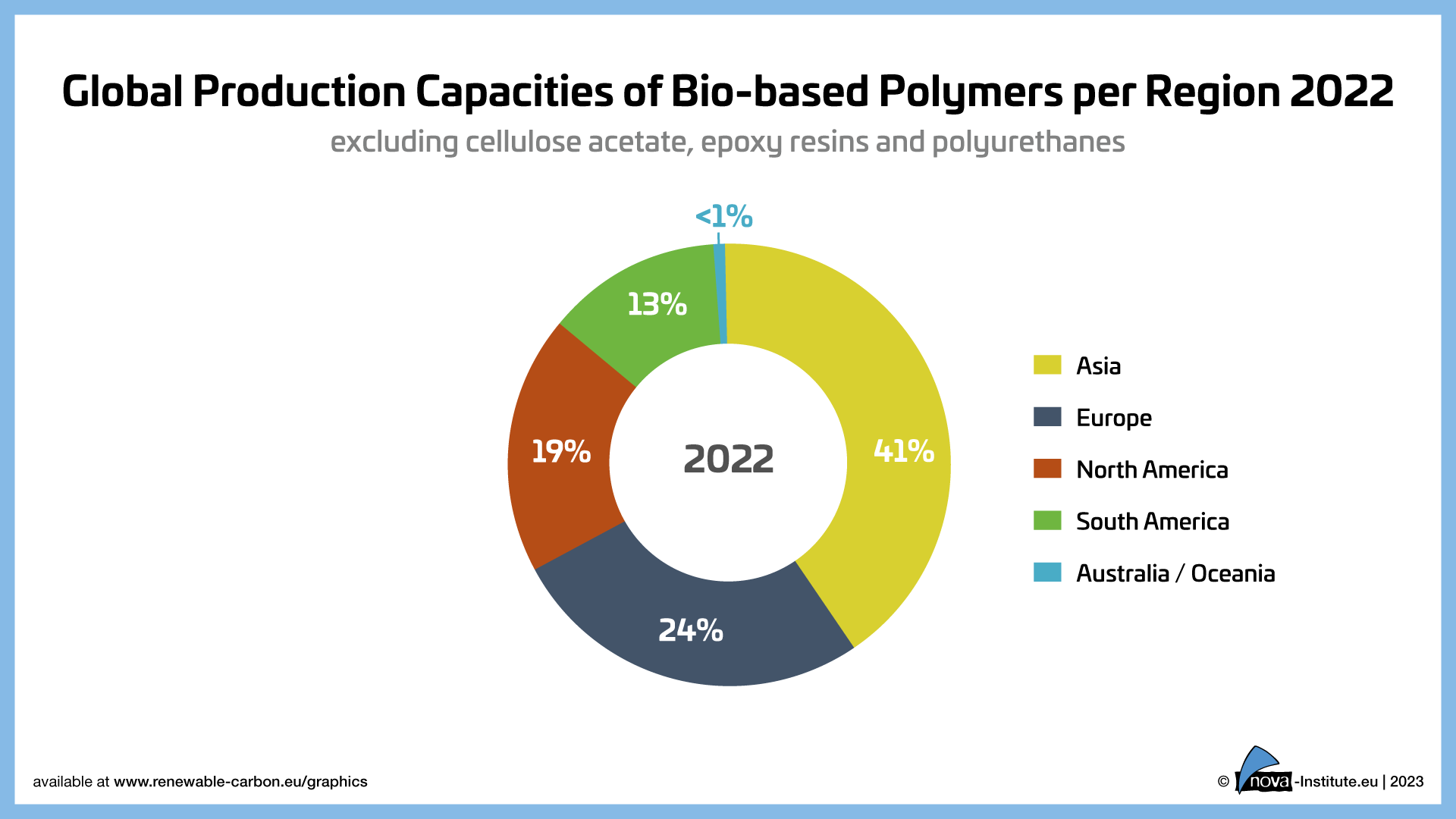

Asia has the largest bio-based production capacity accounting for 41% of total capacities led by PLA and PA production, followed by Europe, with 27% mainly based on starch-based polymer compounds, PP and PE. North America accounts for 19% because of PLA and polytrimethylene terephthalate (PTT) production, while South America accounts for 13%, mainly from bio-based PE production.

More interesting information about the report is shared in the press release including feedstock trends and updated market information on bio-based monomers. As for bio-naphtha, I have included a short overview of this market given the sharp increase of mass-balanced-derived polymers coming out of the market, especially from Europe and Asia. The report also provides a comprehensive expert view on Mass Balance and Free Attribution overview as well as on the Packaging and Packaging Waste Regulation. Finally, about 200 detailed company profiles were included in the report from start-ups to multinational corporations.

PS

Please disregard an earlier version of this post that was sent to your inbox.

Discussion

Comments are closed.