Indorama announced on Monday that it will acquire Oxiteno, the chemical subsidiary of Brazilian fuel company Ultrapar Participacoes SA, for $1.3 billion, subject to adjustment and closing, with a deferred payment of $150 million in 2024. The transaction is expected to close in Q1 2022.

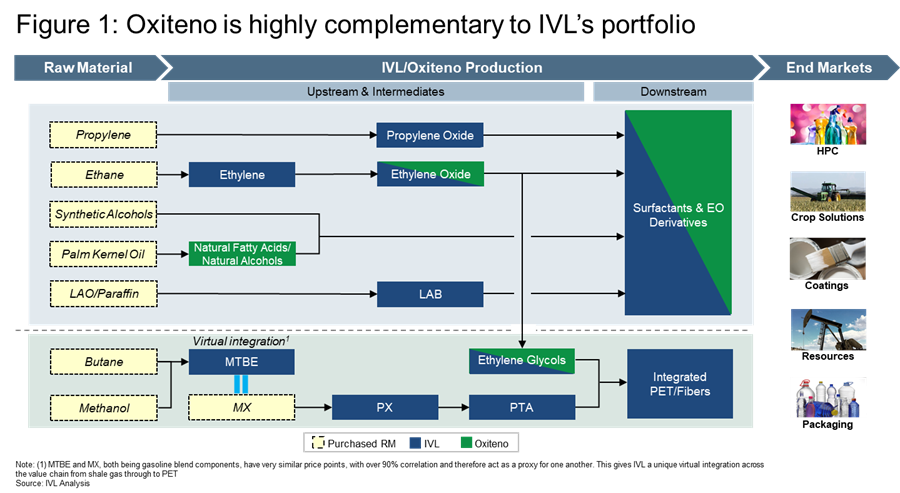

Oxiteno is an interesting acquisition for Thailand-based Indorama Ventures not only because it will place Indorama as a major surfactant player in the Americas offering partially bio-based surfactants (given Oxiteno’s portfolio of oleochemicals) but in my personal opinion, Oxiteno’s location in Brazil will also open up for Indorama a potential source of bioethanol-derived chemical intermediates both in surfactants and polyester markets. Ultrapar, by the way, is heavily vested in the distribution and marketing of Brazilian ethanol.

Indorama’s press release especially noted Brazil as the home to the largest inventory of ethanol used to produce bio-ethylene to enhance ethylene oxide derivatives and PET sustainability. Indorama is already a purchaser of bio-based monoethylene glycol (MEG) mostly sourced from India to produce bio-PET worldwide for customers such as Coca-Cola.

FYI, a US-based engineering firm deeply entrenched in ethanol-to-ethylene projects recently noted to the blog that there have been surging interests for ethanol-based ethylene/ethylene derivatives projects in the western markets. We are certainly looking forward to how this acquisition will progress and if we are going to see Indorama more active in the ethanol-based ethylene/derivatives space. Maybe we will soon see 100% bio-based ethylene oxide and EO-derivatives from Indorama like what Croda is currently offering in the USA and what Clariant/India Glycols JV will soon offer from India?

FOLLOW ME ON THESE SPACE

Discussion

Comments are closed.