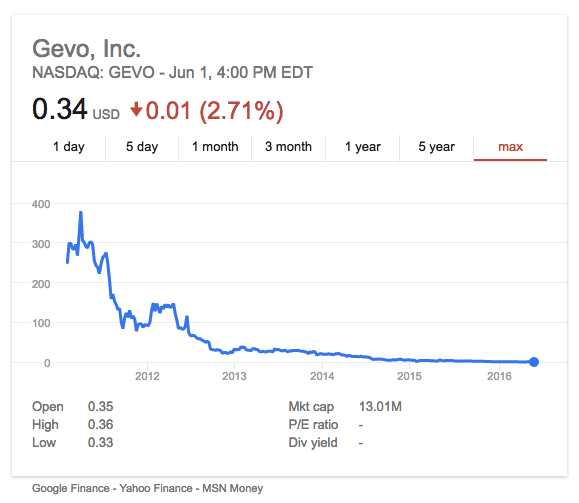

The past year and a half (or almost two years) has been very hard for public chemical companies as Codexis and Solazyme (now Terravia) reinvented themselves, while Gevo and Metabolix shareholders seem to be now looking into selling the companies as options due to financial difficulties.

Gevo just announced that it hired Cowen & Company to explore strategic and financial alternatives that will be in the best interests for all of its stakeholders in order to maximize the value of Gevo. No other pertinent information was disclosed. According to this article from the Denver Post, Gevo ended its most recent quarter with a deficit if $343.1 million and the company’s working capital is now insufficient to pay for operations through the rest of the year as disclosed by the company’s May 12 SEC filing. Gevo had $8.6 million in cash and cash equivalents on hand at the end of March.

Gevo noted on its fourth quarter earnings conference call in May that it was finally able to produce around 50,000 gallons of corn-based isobutanol since the restart of its Luverne, MN, facility in March following the completion of a $5 million capital improvement projects undertaken at the facility to decrease the cost of isobutanol production. The Denver Post further reported that Gevo needed further capital to build out its production plant in Luverne, switch production entirely to isobutanol, and add a jet fuel/isooctane plant.

Metabolix announced in mid-May that is also exploring strategic alternatives for its PHA specialty biopolymers business and for its Yield1o crop science program citing outside interests for its business and a challenging financing environment as reasons. Alternatives may include selling the specialty biopolymers business to a third party and either refocusing the Company’s resources on development and commercialization of Yield10 Bioscience or potentially selling the Yield10 business as well.

The company has been working on the potential spin out of Yield10 Bioscience for the past several months and is currently gauging interest among ag players and VCs for the potential sale as opposed to continuing to develop the crop science business internally.

As of 31 March, Metabolix reported unrestricted cash and cash equivalents of around $5.3 million. The company is seeking additional funding to complete its review of strategic alternatives. In addition to traditional equity financing and its equity facility with Aspire Capital, Metabolix is said to be exploring the availability of equity or debt bridge financing, including debt financing that may be secured by the Company’s IP and other assets.

On 18 May, Metabolix announced that it was able to raise $2 million in a license agreement amendment with Tepha Inc., a Massachusetts-based medical device company that licenses Metabolix’s PHA biopolymer technology for use in certain medical applications. Tepha was spun-off from Metabolix in 2006 by co-founder Simon Williams, It has exclusive rights to PHA for in vivo applications and uses it for absorbable sutures, cardiovascular devices and drug delivery systems (I kind of missed learning these subjects…).

The license amendment calls for a $2 million lump sum payment in exchange, Metabolix agreed to forgo future royalties under its existing license agreement with Tepha, and to provide two additional Metabolix production strains and related IP to Tepha for use in the production of its medical devices.

FOLLOW ME ON THESE SPACE

Discussion

Comments are closed.