The blog will be quiet on Tuesday and Wednesday as I study for my first school exam. Now I remember why I haven’t been actively looking for a job! Keeping my fingers crossed that I’ll be graduating by December.

In the meantime, here are compilations of several recent partnerships between major automotive company and renewable fuel/chemical companies.

Like consumer goods companies, the automotive supply chain is one of the pioneers in adopting bio-based chemicals (and biofuels of course although US auto manufacturers are still grumbling about engine compatibility especially with certain ethanol blends…).

This week, algae developer Joule announced its partnership with German automotive manufacturer AUDI AG — a subsidiary of Volkswagen AG — in the development and future use of Joule’s Sunflow-E (which stands for ethanol), and Sunflow-D (which stands for diesel).

Joule said the relationship will help spur production of Joule’s biofuels including fuel testing and validation, lifecycle analysis and support for Joule’s SunSprings demo facility in Hobbs, New Mexico, which began operating this month.

Joule announced that it has already achieved productivity rates for its ethanol at 15,000 gal/acre/year in the lab and 8,000 gal/acre in outdoor production. Joule ultimately targets productivity of up to 25,000 gallons of Sunflow-E per acre annually, at costs as low as $1.28/gallon without subsidies.

Sunflow-D is reportedly in development with an ultimate productivity target of 15,000 gallons/acre/year at costs as low as $50/barrel without subsidies.

Joule said it will benefit from Audi’s considerable expertise and global reach as well as from the strength of its brand. In turn, Audi said it will have a first mover advantage as Joule’s exclusive partner in the automotive sector.

Meanwhile, Audi’s parent company Volkswagen, has also been busy earlier this year as it announced its partnership with Amyris and Solazyme last March to evaluate the use of each of the company’s respective advanced biodiesel technology in Volkswagen’s TDI Clean Diesel technology incorporated in the 2012 Passat and 2012 Jetta models.

Amyris has been developing its Biofene farnesene-based renewable diesel while Solazyme’s technology harnesses the oil-producing ability of microalgae to produce its SoladieselRD fuel. The US Environmental Protection Agency (EPA) has already approved Solazyme’s registration for its biodiesel which enables the company to market the biofuel either in blended and unblended (R100) forms.

Both Amyris and Solazyme have 12 months evaluation period to equip Volkswagen engineers data for the automotive company to measure environmental impacts from the use of each renewable diesel formulas. Volkswagen said their clean diesel TDI models accounted for 22% of their 2011 sales, significantly up over the past recent years.

[youtube=http://www.youtube.com/watch?v=-dTqvIHuCtM&w=500&h=315]

Of course, there is also Zeachem, which has a partnership with Chrysler that was announced last year. Zeachem started its 250,000 gal/year biorefinery facility in Boardman, Oregon, early this year that can produce cellulosic ethanol (or ethyl acetate or acetic acid) using woody biomass for feedstock.

The primary alliance goals, according to the companies are to “strengthen the credibility among regulators and American consumers of cellulosic ethanol as a cost-effective green transportation alternative; move away from the “food for fuel debate;” provide a leadership role to bring cellulosic ethanol through the production value chain to the consumer market; and build awareness of the potential environmental advantages of high yield, low carbon cellulosic ethanol.”

Renewable-based aromatic chemicals and biofuels developer Virent has partnered with Honda Motors since 2006, and according to Virent, “Honda has given the company access to expertise and testing resources in both current and future engine configurations.” Honda Strategic Ventures has been one of Virent’s stakeholders since 2006.

In 2008, General Motors (GM) has also invested in both cellulosic ethanol developers Mascoma and Coskata. I’m sure there are other renewable chemicals/advanced biofuels companies that have already partnered with major automotive firms but its 2am and my brain says I need to go to sleep now…

By the way, I came across Lux Research’s blog stating that the automobile industry (and OEMs –original equipment manufacturers — in particular) have been expanding their partnerships in the green arena mostly because of rising gas prices, stricter fuel economy standards more environmentally conscious customer base.

In the bio-based chemicals arena, Ford Motors has been in the forefront of developing bio-based automotive components especially in the area of polyurethanes.

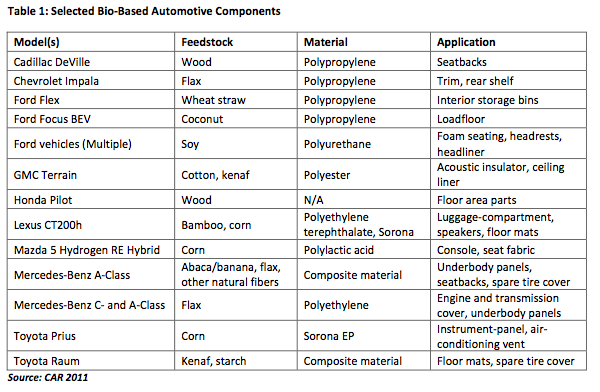

According to a 2012 report titled “Biobased Materials Automotive Value Chain” published this year by the Center for Automotive Research (appropriately acronym CAR), most automakers have not publicly stated specific targets for use of bio-based materials in their vehicles with the exception of Toyota, which announced in 2008 its plans to replace 20% of the plastics used in its automobiles with bio-based plastics by 2015.

The report has great lists of bio-based materials currently being used in branded vehicles as well as the suppliers involved in bio-based materials for automobiles.

As I can’t keep my eyes open anymore, here are some of the past press announcements from various auto manufacturers that has been accumulating dusts in the blog’s draft box…

FOLLOW ME ON THESE SPACE

Discussion

Comments are closed.