If you read some of the message boards about the Gevo stocks, you can see questions hanging in the air on where this company is heading this year as investors anticipate Gevo’s announcement of its 4Q and 2014 annual financial results on March 26.

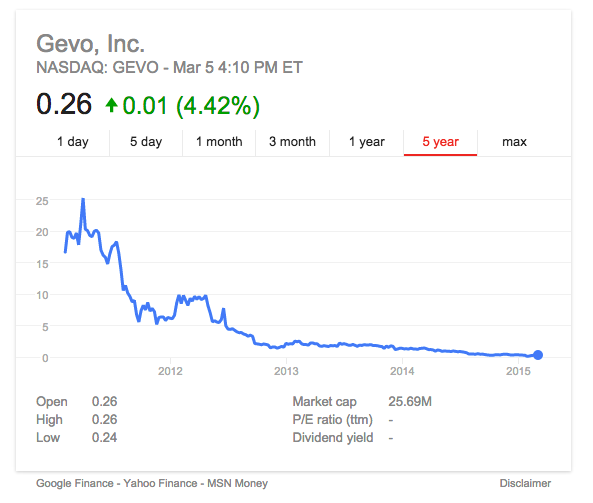

Based on this stock chart, it has been a very difficult few years for Gevo as the company was previously unable to fulfill its bio-isobutanol production milestones in time at its Luverne, Minnesota, facility. As of January 2015, Gevo said it had produced over 50,000 gal of bio-isobutanol in a single month by the end of 2014. This is still below its production goal levels of 50,000-100,000 gal/month. The company was able to increase its fermentation rate by 20% using second generation yeast isobutanol biocatalyst.

Luverne’s capacity is constructed to handle full rate production of around 2-3 million gal/year. Gevo expects that current monthly isobutanol production capability is approaching 75,000-100,000 gal/month. The company was also able to run a production rate of 5,000-10,000 gal/month at its demonstration plant in Silsbee, Texas, that can produce renewable isooctane, jet fuel and paraxylene based on isobutanol feedstock.

The company churned out several news the past two months that lifted stocks in mid-February after a free-fall in January when the company announced cost-cutting measures. There was the news in late January that the US Supreme Court has overturned an earlier Federal Circuit Court of Appeals ruling on the interpretation of key patent claims. The Supreme Court ruled in Gevo’s favor reinstating that Gevo did not infringe on Butamax’s certain patents. It is expected that most of the disputes between Gevo and Butamax are going to be settled this year.

In mid-February, Gevo appointed Andy Marsh, president and CEO of Plug Power (hydrogen and fuel systems manufacturer) as a member of its Board of Directors.

In mid-January, Gevo announced its partnership with Brenntag Canada for sales of bio-isobutanol. Brenntag has reportedly purchased quantities of isobutanol for distribution to targeted customers. In a private interview, Gevo said there is a commitment supply contract in place with Brenntag just like Gevo’s other partnerships, and this is not a one-time distribution deal.

In mid-January, Gevo announced its partnership with Brenntag Canada for sales of bio-isobutanol. Brenntag has reportedly purchased quantities of isobutanol for distribution to targeted customers. In a private interview, Gevo said there is a commitment supply contract in place with Brenntag just like Gevo’s other partnerships, and this is not a one-time distribution deal.

Another positive announcement is confirmation from a consortium of organizations from the US recreational marine industry about several test results showing that isobutanol blends of up to 16.1% can be used in marine engines without deterioration of engine or boat performance. The tests were performed in collaboration with the National Marine Manufacturers Association, the American Boat and Yacht Council, and several engine and boat manufacturers across the industry.

Through a recent public offering of common stock and warrants, Gevo noted (two weeks ago in a private interview) that it was able to raise almost $7 million. A few industry observers note that this recent influx of cash is an equivalent of 3 months worth of operations based on Gevo’s previous quarterly cash run rate. This could buy the company more time to work on its balance sheet for this year. There was a recent announcement of a shareholder special meeting on April 13 but given that I am not familiar with financial jargons, I leave this news for readers to decide what this special meeting means.

In my interview with Gevo, the company, expressed most of its excitement in the development of renewable hydrocarbons across its pipeline of future products. The company has already been developing intermediates from bio-based isobutanol such as paraxylene (PX) which is a major component in the production of PET, as well as ethanol-based hydrocarbons such as ethylene and other derivatives of ethylene (e.g. polyethylene). The company also mentioned development of bio-acetone, renewable hydrogen, bio-polypropylene, and bio-polystyrene. Gevo claimed to have already filed patent applications for these new technologies.

Traditionally, butenes have been produced as co-products from the process of cracking naphtha in the production of ethylene. Isobutanol can be dehydrated to produce butenes, which can then be converted into lubricants, methyl methacrylate and rubber applications. The global market for butenes is estimated at around 2.1 billion gal/year.

From its last operating results update, Gevo said it expects to operate the Luverne plant this year to maximize cash flow from the facility, while continuing the optimization of its isobutanol technology on a commercial scale. Over certain periods of time, the company could solely produce ethanol across all of its four fermenters but the company anticipated continuing some level of isobutanol production going forward to supply customers.

The renewable chemical industry is currently being challenged by cheaper availability of petrochemicals because of lower global crude oil costs. Most renewable chemicals, especially drop-ins that do not have special higher-performance properties to offer, will have a hard time competing in the market when crude oil cost is below $50/bbl. Gevo’s previous target selling price for its bio-isobutanol is between $3.50-4.50/gal. Petro-based isobutanol as of January 2015 was around $4.50/gal ddp US Gulf. The price of petro-isobutanol in January 2014 was around $8.80/gal.

While hydrocarbons seem to be the more profitable area to go into, Gevo said it is still active in the fuels market for its ethanol product. Unfortunately, producer margins for ethanol is also suffering as gasoline prices continued to go down, and ethanol prices therefore had to follow.

FOLLOW ME ON THESE SPACE

Discussion

Comments are closed.