While I’m looking at my emails, I saw Gevo’s announcement this week on its Luverne, Minnesota, facility update stating that the company will cut back its isobutanol production and instead will produce more ethanol.

The company started its 18m gal/year bio-isobutanol (or the equivalent of 22m gal/year bio-ethanol) production this year with a goal of producing bio-isobutanol at a run rate of 1m gal/year by year-end 2012, and at full capacity by year-end 2013.

On Monday, Gevo said it will not be able to achieve its desired year-end run rate, and instead that will (hopefully) be achieved by next year.

“We have decided to optimize certain specific parts of our technology to further enhance bio-isobutanol production rates. In order to maximize cash flow, we believe it makes more sense to temporarily shift to ethanol production.” – Gevo

My first thought about this is if Gevo is going through the same production snag as Amyris. For those who are not familiar with Amyris, the company cut its production target early this year as well and has scaled back its farnesene “Biofene” production plans. Amyris was originally planning to produce 40m-50m liters of Biofene this year but since February, it has eliminated reporting production forecasts on its quarterly earnings and has instead only provided production results and updates on their progress.

Gevo said while production start-ups are “never easy,” the company claimed it is still years ahead of its competitors when it comes commercial-scale production. The company is also now avoiding too many “rigid milestones” promises, according to CEO Pat Gruber on a conference call.

According to an article from Associated Press published yesterday, Redfield Energy — which has teamed up with Gevo to convert a 50m gal/year ethanol plant in Redfield, South Dakota — now also expects the Redfield project to be delayed from 2013 to 2014

Gevo stocks plunged by 44% since Tuesday morning from around $3.30/share to $1.89/share seen today after the market closed. Securities firm Cowen downgraded Gevo from Outperform to Neutral while UBS also downgraded Gevo from Buy to Sell.

UBS analysts Mahavir Sanghavi and Gregg Goodnight noted on its research report (published via istockanalyst.com) that it will be at least 6 months before Gevo switches its Luverne plant back to isobutanol.

The analysts believe that even with Gevo’s temporary switch to ethanol production, Gevo’s existing cash will last only for 7 quarters and that even in best case scenario of a 6 month push-out, they estimate that Gevo will now be EBITDA break-even in 2015 as it needs its first two plants (Luverne and Redfield) running at full-scale to breakeven.

The analysts said an earlier than Q2 2013 isobutanol production start-up at Luverne with a steady state profitable production process in the second half of 2013 could provide support.

Securities firm Raymond James, however, was more positive about Gevo’s announcement, according to this article from Platts.

Raymond James’ Pavel Molchanov noted on its recent equities report, that Gevo’s decision to temporarily switch back to ethanol — a switch enabled by its plant architecture — should be seen as just the latest example of the industry’s frustrating but inevitable growing pains.

Molchanov also pointed to Gruber’s mid-August purchase of $49,000 in company shares as evidence that the announcement should not scare away investment.

Gruber noted in the conference call that the production scale-down will not affet its bio-isobutanol supply agreements with chemical company Sasol and fuel distributor Mansfield Oil.

|

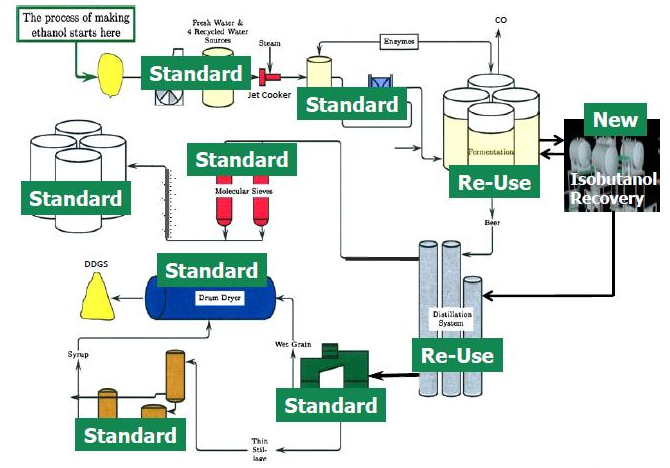

| Gevo bio-isobutanol/ethanol process |

Discussion

Comments are closed.