I usually shy away from posting market studies and reports on bio-based chemicals because a) there are a lot of inflated figures being reported in the big world wide web; and b) it is frowned upon since I’m working for a consulting firm myself.

However, nova Institute is a well-established, well-known expert in reporting about biopolymers worldwide and its annual report is being used by the European Bioplastics trade organization (and other European agencies). I also need to disclose that Tecnon OrbiChem has started collaborating with nova Institute last year and therefore I do have some contributions to nova Institute’s latest biopolymers and bio-based building blocks annual report.

The Asia report below is part of the annual biopolymers study, and is written by nova Institute’s biopolymer expert, Wolfgang Baltus of Wobalt Expedition Consultancy.

This new nova trend report “Asian markets for bio-based chemical building blocks and polymers” shows the latest data and development in China, Japan, Malaysia, South Korea, Taiwan and Thailand. A global capacity of 2.4 million tonnes bio-based polymers was established in 2016, from which more than 45% of the most important bio-based polymers are produced in Asia.

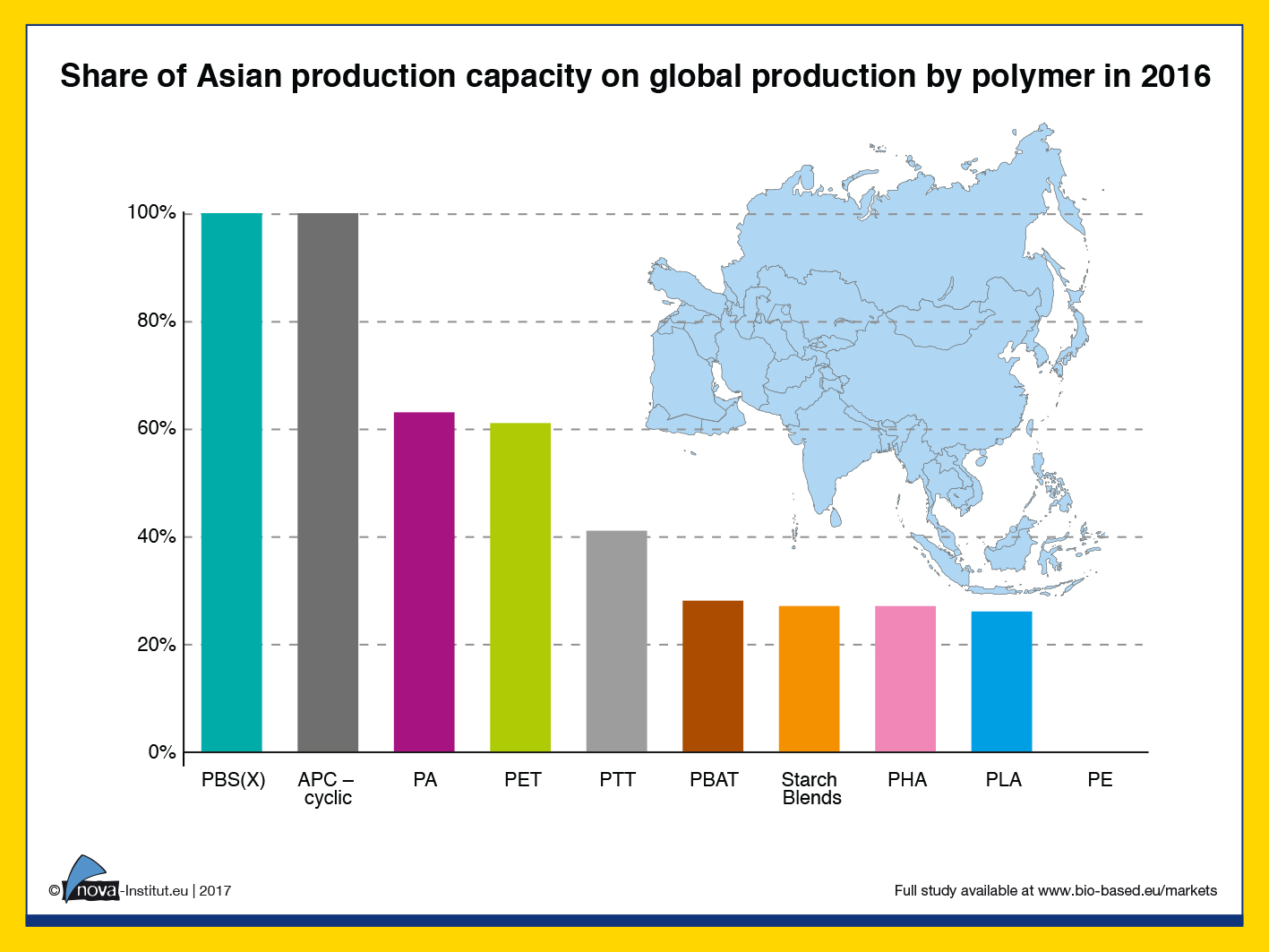

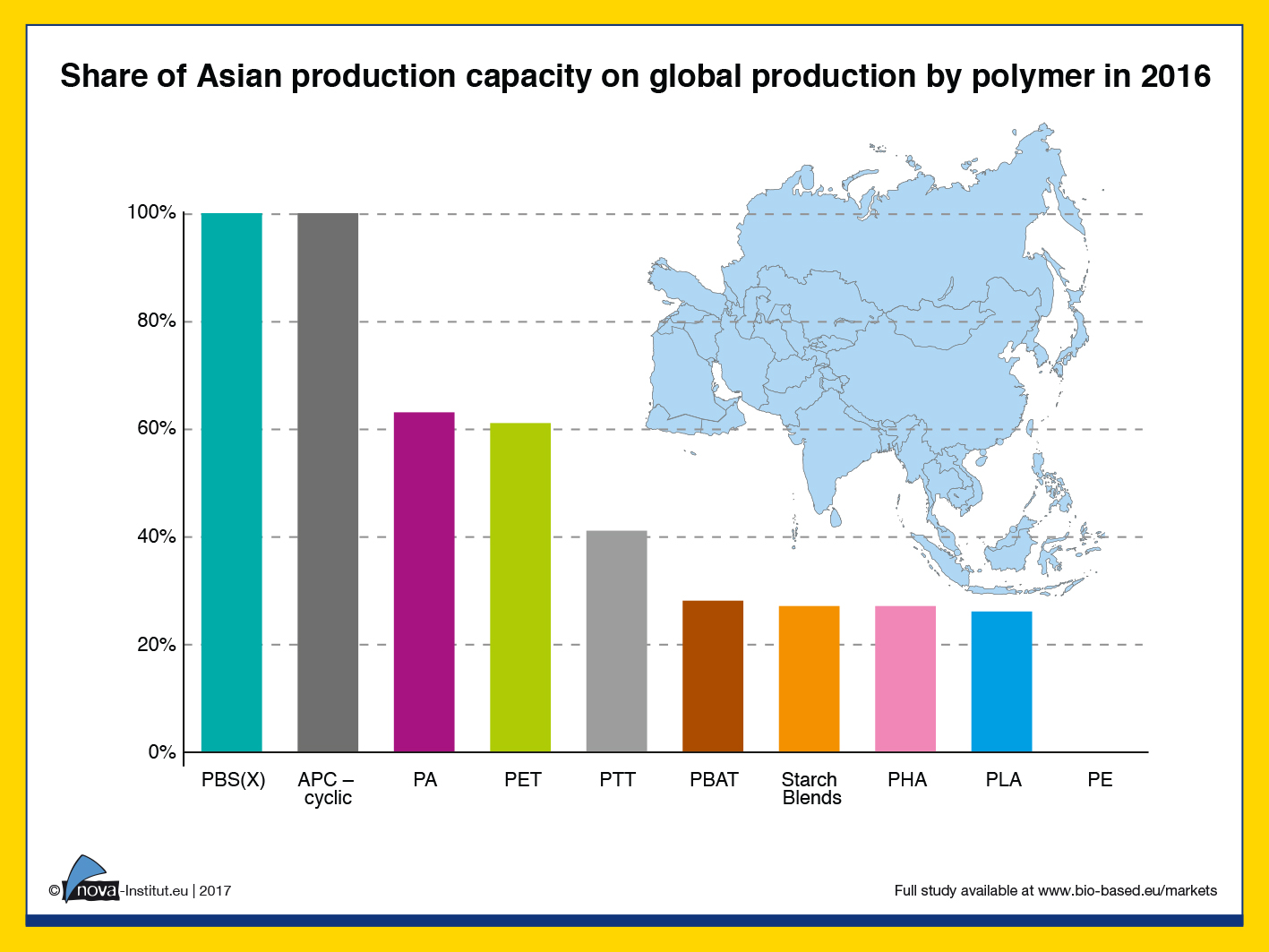

The worldwide capacity is expected to reach 3.6 million tonnes in 2021, nearly 52% of this volume will be installed in Asia. This equals an increase of installed capacities of 71% in the next five years. The Asian region has a 100% share in production capacities of PBS(X) and cyclic aliphatic polycarbonate (APC) since several years as is shown by Figure 1.

For bio-based building blocks, the report sees an increase of the implementation of biorefineries and bio-hubs in South-East Asian countries to strengthen their competitiveness. Stronger emphasis on cooperation and partnership along the value chain and with R&D providers becomes a key factor to success.

Potential investors and customers in Asia are eager for a change in governmental policies and incentives. At the moment, government measures are mostly targeted at enhancing the export capabilities of countries and generating technology transfers. Countries such as Thailand have reacted to the demands of the market and introduced “roadmaps” to support the introduction of bio-based plastics or/and biotechnology.

Main increase of future production capacities (and shares) is expected for PLA and polyamides (PA). PHAs are another biopolymer group in focus of Asia, capacity volumes and underlying trends are another focus of the nova trend report.

The drop-in bio-based polymer PET, which is only partly bio-based at present, holds the major share of the total Asian production capacity. In 2021, PET is expected to contribute with 59% to the total capacity of biopolymers in Asia, which are in focus of this trend report.

“Biodegradable, compostable” polymers (such as PLA, PBS, PBAT, PHAs) are expected to be contributing about 25% to the Asian production of bio-based polymers in 2021. However, that means that about 75% of the total bio-based production in Asia will be focusing on durable polymers.

Bio-based building blocks on the rise

Additionally, biorefinery concepts are emerging in Asia. It will allow producers to diversify economic risks by broadening existing marketing possibilities into additional complementary market segments including the bio-based plastics industry. Current new developments in South-East Asia are even targeting the establishment of large scale bio-hubs, bio-clusters or bio-based polymer parks like in Thailand or Malaysia.

The future focus in Asia will be most likely more on bio-based building blocks such as organic acids, diols or bio-based monomers such as bio-based ethylene, rather than only on bio-based polymers, by integrating the available agriculture resources into the process.

The “Asian Markets” trend report is focussing on aspects and insights of bio-based polymer and building block production in the leading Asian countries including feedstock evaluation, status and trends in policies and market barriers and drivers.

It covers market data for bio-based polymers for 2014 and 2016 as well as a forecast for 2021 and the available biomass feedstock, key to success, is evaluated: Sugar cane, sugar beet, cassava, corn, castor plant, palm oil, rice straw, napier grass and rubber tree.

As leading countries China, Japan, Malaysia, South Korea, Taiwan and Thailand are in the focus of the report with their activities in bio-based LA, PLA, PBS(X), PE, PHAs and PA.

The 53 pages’ report includes 36 figures and 9 tables.

The trend report “Asian markets for bio-based chemical building blocks and polymers” is available for €750 (plus VAT) at www.bio-based.eu/reports.

Author: Wolfgang Baltus, Wobalt Expedition Consultancy, Thailand, in cooperation with the biopolymer expert group of the nova-Institute.