The US Department of Energy (DOE) Bioenergy Technologies Office (BETO), in collaboration with Oak Ridge National Laboratory (ORNL), has rolled out the first volume of its 2016 Billion-Ton biomass report looking into the potential for US to sustainably produce at least one billion dry tons of non-food biomass resources annually by 2040. This is the third in a series of DOE’s assessments that have previously calculated the potential biomass supply in the US in 2005 and 2011. New in the 2016 report are assessments of potential biomass supplies from algae, from new energy crops (miscanthus, energy cane, eucalyptus), and from municipal solid waste. Volume 2 of the report is set for release later this year.

The report findings show that under a base-case scenario, the US could increase its use of dry biomass resources from a current 400 million tons to 1.57 billion tons under a high-yield scenario. This amount of biomass could be used to produce enough biofuel, biopower, and bioproducts to displace around 30% of 2005 US petroleum consumption, and would not negatively affect the production of food or other agricultural products.

Some of the highlights of Volume 1 2016 Billion-Ton report:

- Biomass availability is a function of market, innovation and time

- Agricultural residues, wastes and forest resources are available now; energy crops offer growth potential in the coming years

- Forestry resources are regionally specific and subject to macroeconomic and local market forces

- Prices for delivered supplies are largely accessible, though more logistics systems research is needed

- All identified potential supplies are contingent upon prices

Forest biomass

The study estimates annual gross potential of all forest biomass supply including residues is about 21 million to 116 million dry tons from 2017 to 2040 for both private and federal lands for the baseline scenario at prices between $40 and $80/dry ton. The available woody biomass ranges from 88 million to 82 million dry tons annually under the lowest biomass demand (base case) at a price of $60/dry ton to roadside. For the highest demand scenario, the estimated potential biomass is 60-79 million dry tons/year at $60/dry ton price.

Agricultural Residues and Biomass Energy Crops

Crop residues require no additional cultivation or dedicated land and are considered potentially available in the near term. Residues in the report include production of corn stover, wheat straw, oat straw, barley straw and sorghum stubble.

A sensitivity analysis confirmed that the price offered for biomass resources from agricultural lands has the largest effect on total available supplies. Pastureland intensification, or the displacement of pasture to energy crops, is also found to have a positive impact on the long-term economic viability of energy crops especially miscanthus and switchgrass. In operational efficiency, the reference case assumes a 50% efficiency in 2022, increasing to 90% efficiency in 2040. Varying the energy crop input costs by +/- 10% of feedstock production estimates, it was found to have the greatest effect on miscanthus and switchgrass, with a base-case impact on woody crops and energy sorghum.

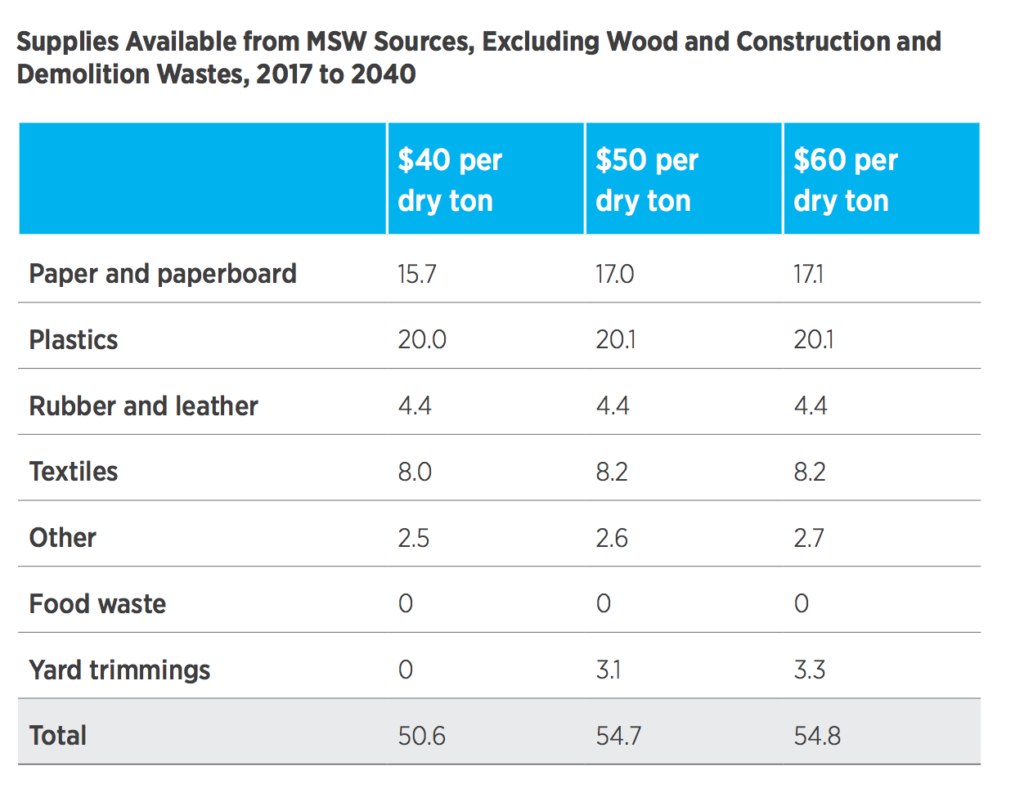

Municipal Solid Waste

The report estimates that annual gross potential of MSW biomass supply is about 51-55 million dry tons at prices of $40/dry ton. These estimates represent cost and availability from 2017 to 2040. The potential supply is dependent on several factors such as future population growth, innovation in logistics and handling, efforts to reduce, reuse and recycle, and local waste handling contract challenges and opportunities. MSW represents a biomass resource as nearly 40% of the total national potential biomass waste resource (54.8 million dry tons out of a total 142 million dry tons available at $84 or less per dry ton).

In the report’s baseline scenario, total MSW potential is 20% of all feedstock potential at $60/dry ton or less, meaning around 139 million dry tons out of a total feedstock volume of 707 million dry tons available in 2017.

The report estimates that majority of MSW biomass supply is in the form of plastics. There are potentially 20 million dry tons of plastics available for use in bioenergy production, representing 39% of the total MSW supply. In 2013, 134 million tons of residential and commercial garbage was sent to landfill, representing about 35% of total MSW generated. The rest were recycled/composted or used for bioenergy production.

Yard trimmings are around 13.5% of the MSW generated and 8% of MSW discarded to landfills. Roughly 4.3 million dry tons are used for waste-to-energy purposes, with a potential increase in availability at a higher price point. Around 3.3 million dry tons are estimated to be recoverable at $60/dry ton.

Urban wood waste (such as wood waste from construction and demolition materials) is not included in MSW biomass supply but categorized under forestry wood waste. Urban wood waste account for 23.3 million dry tons at a cost ranging from $24-49/dry ton. Cooking oils, food processing wastes, utility tree trimmings and biosolids are categorized with landfill gas, and together, account for an additional 19.3 million dry tons in 2040.

Cost estimates were derived from state level average MSW tipping fees, which range from $18/ton in Idaho to $105/ton in Massachusetts. Counties with population less than 250,000, all material is assumed to be available at the state-level tipping fee, plus a sorting cost of $60/ton. Population greater than 250,000, sorting cost was estimated at $40/ton. In the US, majority of plastics are disposed in the landfill, rather than used for energy recovery due to perceived risk of atmospheric release of chemicals.

Algae

The report estimates the site-specific and national economic availability of algal biomass under co-location scenarios that use waste CO2 from existing point-sources for cultivation. Three significant sources of waste CO2 were selected, representing a range of purities and geographic distributions: natural gas electric generating units (EGU), coal EGU and ethanol production facilities. These represent around 86.6% of CO2 emissions in the US. The analysis identified 74,606 unit farms throughout the US totaling around 139,886 square miles that are potentially suitable for large-scale, open-pond algae production.

These three co-location scenarios has a defined cost limit of $40/ton of CO2 to avoid exceeding projected commercial supply costs. In addition, current cultivation productivity rate scenario and a future higher productivity scenario are presented for both freshwater and saline water algae strains. BETO supports the annual domestic production goal of 5 billion gallons of algae-based fuels by 2030.

Logistics

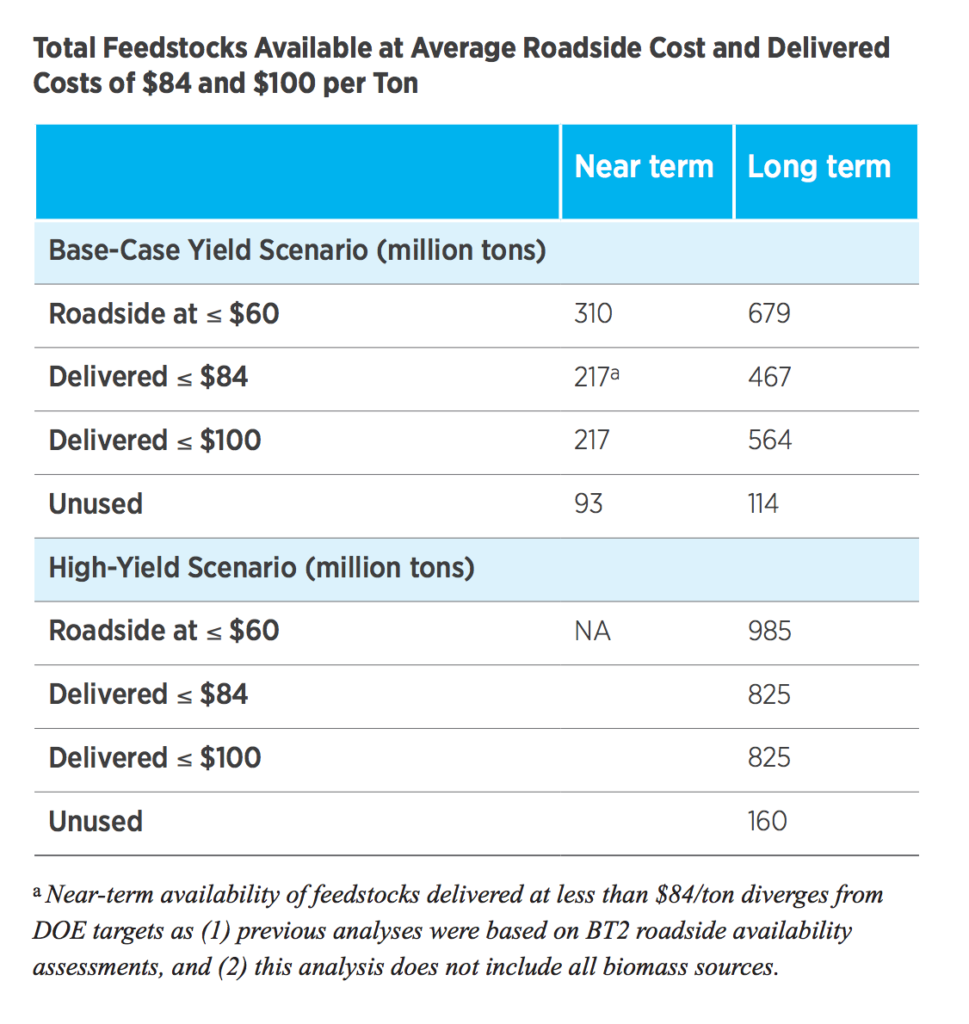

To illustrate how select biomass feedstocks can efficiently and cost effectively be delivered to biorefineries, the study presents a scenario analysis to incorporate transportation and logistics costs to the final feedstock prices. In the proposed delivery system, feedstocks will be transformed into intermediate products at a regional processing facility before being converted to biofuel, biopower or bioproducts at a biorefinery. In the future, a feedstock supply system that includes a pre-processing depot to aggregate multiple feedstock sources and multiple end uses could transform raw biomass into a stable commodity suitable for long-distance transport and handling in existing infrastructure.

The study presents an assumption that a traditional delivery system focusing on just one feedstock source and a single end use will remain in place for the near term. This assumption estimates 217 million tons of biomass could be available at a delivered cost less than $84/ton (assuming a roadside/farmgate price of $60/ton). Long term, assuming the development of the proposed delivery system as well as additional feedstocks and increasing yields, around 467 million tons/year could be delivered at the cost target of $84/ton. In the long term high-yield scenario, total feedstock quantities increase to 825 million tons at a delivered cost of less than $84/ton.

Readers can access the report and other visuals at this link: https://bioenergykdf.net/billionton2016/overview