For the past several months now, I have been covering several renewable-based and biotechnology-based surfactants for Tecnon OrbiChem’s Bio-materials reports (mostly under oleochemicals) but let’s go back again to sugar-based surfactants such as glycolipids.

Last year, the blog reported about Logos Technologies’ NatSurFact® line of biodegradable surfactants based on rhamnolipids. As I have reported in the past, the market for rhamnolipids is very small and their price is quite expensive. The challenge is that the recovery and purification of rhamnolipids at industrial scale is costly. Downstream processing for biosurfactant production reportedly accounts for 70-80% of the entire production costs. Some of the market price for rhamnolipids that the blog got was around $200-227/10 mg where purity is around 95%. Rhamnolipids have been reported to be produced at levels up to 100 g/L, in comparison to sophorolipids which can be produced at levels exceeding 400 g/L.

Aside from Logos Technologies, other producers/developers include AGAE Technologies, Rhamnolippid Companies, GlycoSurf and TensioGreen. It is believed that Ecover and Henkel are also working on rhamnolipids. I also just discovered this company in China, Daqing Victex Chemical Co. Ltd., who seems to have been producing rhamnolipid biosurfactant as well in Heilongjiang Province. The company is believed to have produced 100 tons last year and most of them are exported to North America.

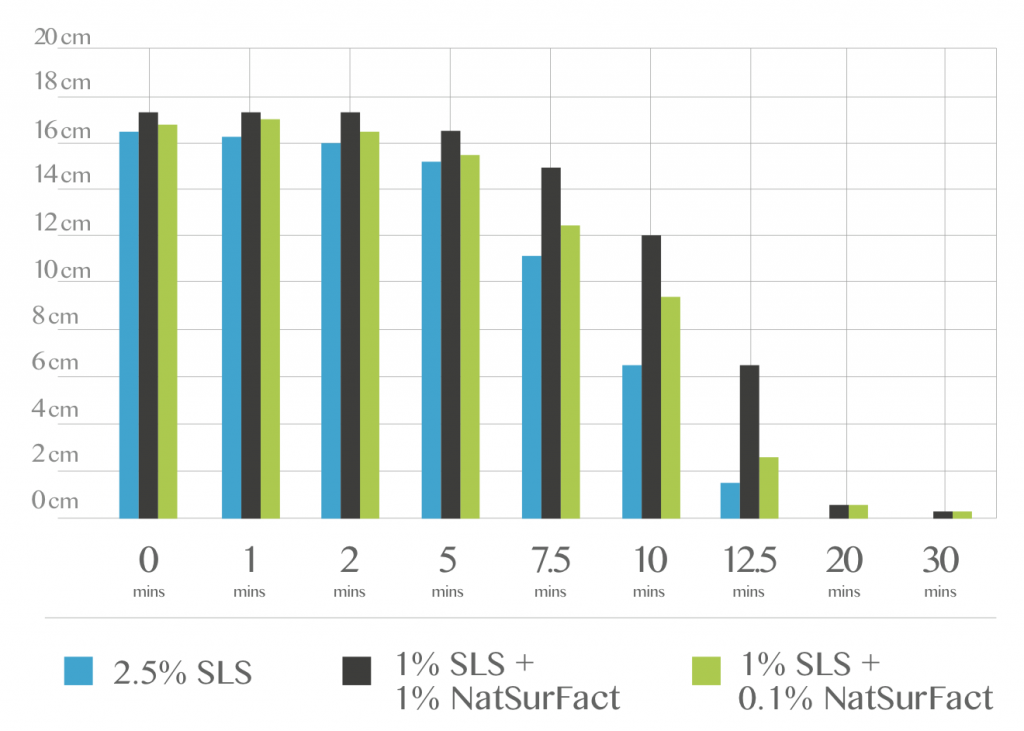

Logos Technologies said it can produce several grades of NatSurFact® and tailor them to customers’ specifications, from applications in personal care and household cleaners to chemical enhanced oil recovery (cEOR). According to the company, only milligrams per liter of rhamnolipids are necessary to make water “soapy”. Rhamnolipids, a class of microbially-produced glycolipids, also reduce surface and interfacial tension, with a hydrophilic-lipophilic balance in the range that makes them detergents and oil-in-water emulsifying agents.

Rhamnolipids consist of either one rhamnose sugar (mono-rhamnolipid) or two rhamnose sugars (di-rhamnolipid) covalently linked to two fatty acids, typically 3-hydroxydecanoic acid. They are composed of only carbon, hydrogen and oxygen.

Logos Technologies said its surfactant is compatible with current chemical mixtures used in popular personal care and household cleaning products tested so far. Because of its high activity compared to conventional surfactants, the company claims the product goes a long way. Large orders will receive pricing that is competitive on a dollar-per-activity basis. From the blog’s reporting last year, the company has been producing rhamnolipids at a pilot scale with a capacity of around 1 kg/week of active material using natural oil for feedstock. Logos Technologies is actively exploring partnering options for bringing NatSurFact® to market.

By the way, not related to surfactants but Logos Technologies is also currently developing bio-based methyl propyl ketone under the trademark e-Ketones using the company’s proprietary biochemistry.

Now back to surfactants, the blog has also been in communication with GlycoSurf’s CEO, Chett Boxley. The company said it has also produced rhamnolipids that are more than 95% pure (often 99% pure) just like Logos Technologies. The difference with GlycoSurf is that its rhamnolipids is produced via chemical synthesis and not through microbial fermentation process. GlycoSurf uses the rhamnose sugar as feedstock and it can attached whatever lipids it wants to the sugar, therefore making the glycolipid surfactant more tailored to customers’ needs.

The company can therefore cut the costs of fermentation and separation processes, as well as increase the ability to produce in higher volumes. The challenge of course (in my opinion) is sourcing rhamnose sugar at a good price and good volume. I am not familiar with the market for rhamnose sugar (which it seems is extracted in certain plants) but I’m guessing that this is a very small market and price could also be prohibitive depending on how they extract rhamnose sugar from plants. Maybe somebody can give me an overview of this market.

GlycoSurf said it has a supplier of rhamnose sugar. The company is also currently trying to minimize the processing steps to attached rhamnose to lipids in order to cut costs. GlycoSurf is an off-shoot start-up from the University of Arizona (UA) which had funding assistance from Tech Launch Arizona. The company was officially formed in 2013. Last year, GlycoSurf moves into a laboratory at a local Tucson incubator, the Arizona Center for Innovation at the University of Arizona Tech Park and installed a reactor at the Center to begin product scale-up and manufacturing for sale and distribution.

GlycoSurf recently announced that it has finalized an exclusive agreement for a novel chemical synthesis of glycolipids technology, which was created at UA. The company is focusing its first application in the cosmeceutical space that includes anti-aging creams and sunscreens. The company has been producing larger than kilogram batch early this year mostly for customer testing in the R&D level. By the way, L’Oreal has already been using rhamnose sugar for its Vichy anti-aging/moisturizing skin care line. I am not sure if there are companies who are already commercially marketing rhamnolipids-based cosmetics/personal care.

It seems the recent cost of rhamnolipids is around $350/10mg for 98% purity. Rhamnolipid from China is around $11/kg for purity between 40% and 85% in barrel batch quantities, according to sources. This still needs to be verified.

According to GlycoSurf, the global market for surfactants is expected to generate revenues of more than $41 billion by 2018 with growth of 4.5%/year. Biosurfactants represent a huge growth opportunity.

As I’ve mentioned in the previous post, I will be attending the World Surfactants Conference next week to be held in New Jersey and hosted by ICIS and Neil Burns LLC. I’m excited to get updates on the surfactants market including oleochemicals, bio-based EO and other bio-surfactants. Let me know if you want to have a brief chat during the networking! Also follow my tweets via @DGreenblogger during the conference under the hashtag #Surfactants

Speaking of bio-based ethylene oxide (EO), Croda recently had its groundbreaking for its new $170 million bio-based EO plant, which will use corn ethanol for feedstock. The bio-EO plant is going to be built at the company’s Atlas Point site in New Castle, Delaware. The company noted that it will create the first North American plant that will lead to 100% sustainable, non-ionic surfactants and active emulsifying agents. Croda said its ingredients are found in many popular consumer products such as personal care, textiles, detergents and cleaners.

The new bio-EO facility is projected to begin operations in 2017. The company has partnered with Scientific Design Company to design the plant. Walbridge Process Engineering and Construction will serve as the projects’s construction manager. Middough Inc. will complete the detailed engineering and equipment specification.

No word on where or who it will source its ethanol feedstock from. This is an interesting development as more and more are using bio-based ethanol in the US aside from fuel application. Case in point is the announcement by Procter & Gamble for its plan to use cellulosic ethanol as a solvent in liquid detergent formulation.