Hello. It’s me. 😉

Sorry for the long blog hiatus but I am currently in the second leg of my three continent-travel this month. I just came back today from London; flying to San Diego tomorrow, and Philippines the next Monday. Wish me luck!

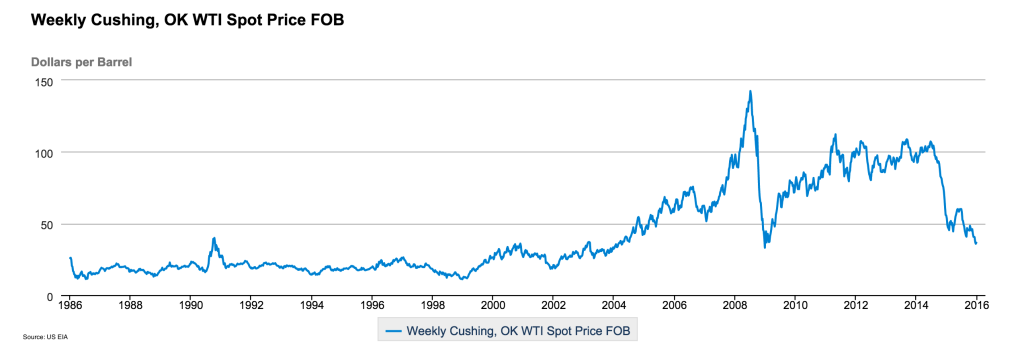

So let’s get on to this review. 2015 is a turning point for many renewable chemicals companies as well as bio-based chemicals projects and strategies. This is mostly because of the continued low crude oil price and associated low petrochemical prices that lingered throughout the year and still continuing today.

This long period of below $50/bbl crude oil price has impacted many commodity chemical prices and led to several companies rethinking strategies. As my boss from Tecnon OrbiChem noted, the chemical industry has adapted to crude oil prices that had been fairly stable at around $100-110/bbl since early 2011, so this slide in prices has caused many heart searching in the industry. Last year in January, Tecnon OrbiChem’s Charles Fryer presented a paper analyzing the likely impact of this low crude oil prices on chemical building blocks.

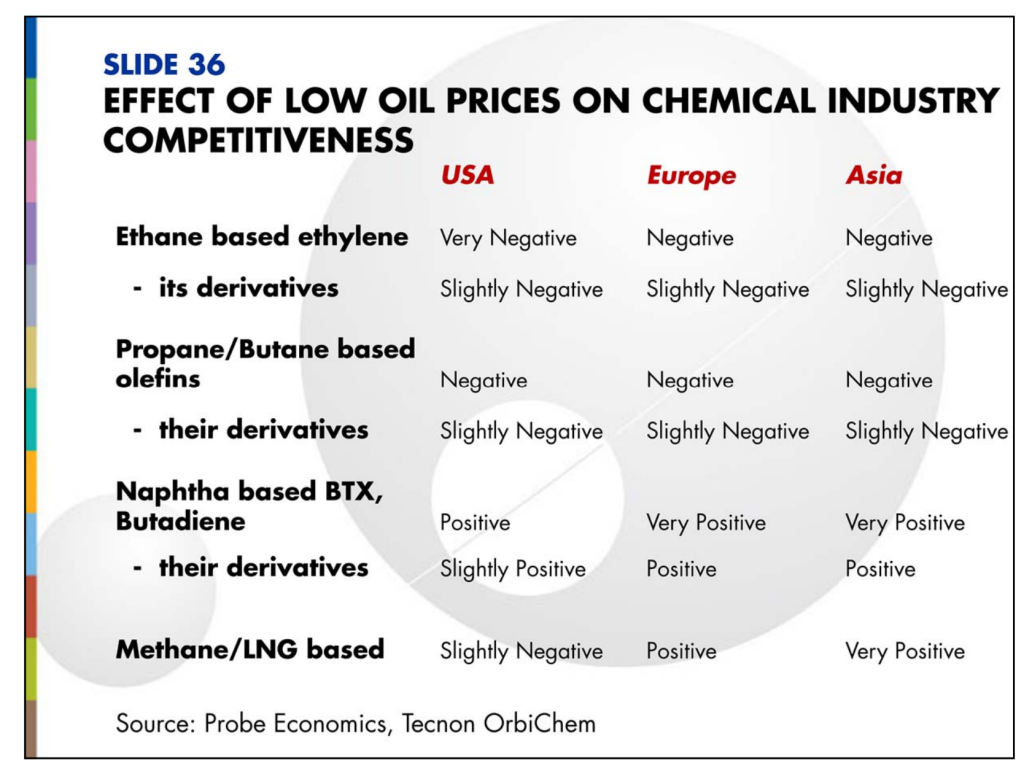

On slide 22, Charles noted that for bio-ethylene production, it could take several years before crude oil prices have recovered to the point where bio-ethylene becomes economically viable – except for applications where a premium price for ethylene derivatives is acceptable. Here is a summary of the presentation on how low oil prices have affected the chemical industry’s competitiveness:

Now let’s take a look at some of the big news and events in the renewable chemicals markets last year.

RESTRUCTURING

We will start with some of the casualties, mergers/acquisitions, buy-outs and pending bankruptcies last year as there were several of them. One of the most recent ones is Abengoa’s filing for insolvency protection in late November after failing to get further financing to pay its debts. Abengoa SA is Spain’s largest renewable energy company but it also has several ethanol facilities in the US including the Hugoton, Kansas, cellulosic ethanol plant, which officially opened in October 2014. It was reported that after Abengoa’s announcement to seek insolvency protection, the company laid off staff at the site and the plant has been temporarily idled. Lay-offs were also noted at other facilities and offices worldwide. Abengoa also has several internal small projects and patents on the bio-based chemicals front such as bio-based n-butanol and catalysts to produce ethanol-based chemicals.

I have reported last year in January the difficulty hitting production targets from public companies such as Gevo, Amyris and Solazyme. These three companies was able to get through 2015 but they are not yet out of the woods especially for Gevo, which has yet to produce significant commercial quantities of bio-isobutanol (December 31 was the last time I checked for any news from them so there could be changes since then). Solazyme, meanwhile has restructured its production capacity late last year as it ended its arrangement with Archer Daniels Midland (ADM), and has shut down its 20 ktpa algal oil production facility in Clinton, Iowa, which ADM owns and operates, as well as the Galva, Iowa, facility, owned by American Natural Processors, where additional downstream processing is done for algae oils coming from Clinton.

Instead, Solazyme will focus on production at the 100 ktpa Moema, Brazil, Solazyme Bunge JV facility, which uses sugarcane for feedstock as opposed to corn-based sugar in Iowa. Solazyme still has its 2 ktpa facility in Peoria, Illinois, which has been producing the Algenist personal care ingredients as well as the Algavia algal flour as well as functioning as an R&D/demo facility. Solazyme expects to save $12-15 million from its current annual run rate by exiting the contracts with ADM and American Natural Processors. I have reported more about Solazyme’s restructuring and re-strategizing its business on my recent Tecnon OrbiChem newsletter.

Amyris seems to be turning around as it focuses less on biofuels and more on specialty chemicals applications (e.g. lubricant ingredients, cosmetics, food ingredients, nutraceuticals, flavors and fragrances, pharmaceutical ingredients, etc) for its farnesene and other new building blocks. According to its last quarter earnings report in November, the company is expected to deliver 2016 as a free cash flow positive year.

Here are some other past buy-outs, acquisition news, restructuring, etc. in 2015:

- Dyadic sells enzyme assets to DuPont

- Kraton Performance Polymers acquires Arizona Chemical

- Cobalt Technologies exit

- OPXBIO exit

- Renmatix acquires Mascoma assets

- BASF halts bio-acrylic acid R&D

There are many more aside from these and I will try to include most of them on my January Bio-Materials newsletter. However, the biggest restructuring that could happen this year is the Dow Chemical/DuPont merger. DuPont has already announced that 10% of its ~63,000 global workforce will be impacted.

DuPont is more inclined towards industrial biotechnology R&D than Dow Chemical. DuPont’s industrial bioscience unit occupied 3% of the company’s sales by segment in 2013. In 2014, its enzymes and related products occupied 81% of the industrial bioscience unit in terms of sales while biomaterials occupied the rest. I wrote more of my analysis on this merger at Tecnon OrbiChem’s December issue and its impact on industrial biotech R&D. While it may take years before the merger dust settles, the future of DuPont’s industrial bioscience unit is unknown but there are questions on the possibility of further trimming on the bio-materials R&D and concentrating more on cost-cutting and defending old core businesses.

COMMERCIAL PRODUCTION

2015 ended with several good notes on start-up production for several bio-based chemicals, expansion of current production or announcements of planned construction for commercial production:

- Cathay Industrial Biotech to expand bio-monomers/bio-polyamides capacity

- Avantium plans for commercial FDCA facility

- GFBiochemicals starts levulinic acid production

- Green Biologics starts bio-butanol plant construction

- DuPont starts cellulosic ethanol plant

- Rivertop Renewables starts commercial glucarates production

- Emery Oleochemicals opens bio-polyols facility

- Newlight Technologies commercial production expansion

- Global Bioenergies, Cristal Union bio-isobutene JV

- Corbion plans for PLA production

- LanzaTech, China Steel in ethanol facility investment

- Bio-on and Pizzoli in PHA plant

BioAmber’s start-up of its 30 ktpa bio-succinic acid plant in Sarnia, Ontario, Canada, was one of the major production news in the bio-based chemicals sector last year. I have reported most of BioAmber’s activities last year under my Bio-Materials’ succinic acid section on Tecnon OrbiChem. BioAmber reported that that the yield and productivity performances in Sarnia are already exceeding the long term targets set for the plant. The purification process has a recovery yield that reportedly has already met the target set for 2015. BioAmber expects production for 2016 at around 22 kt, starting with 4,000 tons in the first quarter ramping up to about 7,000 tons in the fourth quarter of 2016.

I have also reported on my December Bio-Materials newsletter some of the ramp up in global PHA capacity.

INVESTMENTS

As expected, investments in the public sector have slowed down further last year but private and angel investors’ interests are still strong as indicated by last year’s funding activities. I am attending this week’s incoming INFOCAST Bio-Based Summit in San Diego starting Tuesday, and some of the panel discussions are funding opportunities and attracting private equities and capital for commercialization as well as joint ventures and M&As. I am hoping to get more overview of the funding activities from last year and outlook for 2016 at the conference. Follow my twitter coverage of the conference at #Biobased16.

FEEDSTOCK

I have covered the oil sector earlier but I have noticed the stronger pursuit of R&D in the use of biomass feedstock. I am planning a more comprehensive analysis and coverage of this soon on Tecnon OrbiChem’s Bio-Materials newsletter. Last year also saw more activities on the use of methane, carbon dioxide and other greenhouse gas emissions as chemical feedstock.

WHAT’S IN STORE FOR 2016?

Looking at my last year’s review, crude oil price as I have mentioned, was the game changer for 2015. There were talks of stronger climate change focus in Europe and maybe in Asia but not as much here in the US. The weak economy in China is also changing the supply/demand dynamics in the chemical landscape.

For renewable chemicals, there is now more emphasis away from drop-in commodity chemicals (both bulk and intermediates) and more into specialty chemicals and applications to lessen crude oil’s lower-price impact. The merger of Dow Chemical/DuPont has set a grimmer tone towards the future of industrial biotechnology R&D amongst major chemical players, especially in the US, but could open doors for hungrier, smaller chemical companies looking to compete in terms of applications/formulations incorporating sustainable/less carbon-emitting chemicals.

Europe, however, is setting a different scenario where many multi-year industrial biotechnology R&D collaborations from public/private/government sectors along the value chain (agriculture to chemicals to consumer/industrial applications) are coming to fruition. It is up to these various organizations/companies whether they want to take the next step to commercialization. I’ve been seeing a more positive mood in Europe (or I could have imbibed too much wine while there) and that is a good thing to see amid a gloomy global chemical outlook this year that I’ve been hearing thus so far.

One response to “2015: Renewable Chemicals Review”

Does Bio-renewable chemicals means renewable chemicals ?