This post is long overdue but fortunately I will be able to use some of the information here for my incoming presentation at the Plant Bio-Industrial Oils (PBIO) Workshop to be held on March 6-7 in Saskatoon, Saskatchewan.

Some of the blog’s readers have known my work in the oleochemicals and industrial oils markets since 2000 when I first started as staff editor covering the oils, fats and waxes markets for Chemical Market Reporter (the predecessor of ICIS Chemical Business trade magazine).

I also previously posted a presentation that I did in 2005 predicting the growing influence of renewable-based chemicals in the overall chemical market and the increasing use of biotechnology in this industry. As I pointed out in the first slide of this presentation how the chemical industry started with using natural fats and oils for feedstock – think about soaps, varnishes, lubricants..In fact, Chemical Market Reporter first started in 1871 as Oil, Paint and Drug Reporter weekly journal and you can imagine how important natural oils-based chemicals trading were at that time!

The market for natural oils and fats-based chemicals shrinks to teeny-tiny markets as the era of petroleum and petrochemical refineries took place. However, when crude oil price started becoming too volatile and once it passed the $100 per barrel mark for the first time in history, many folks turn their attention back to alternative, natural-based feedstock. At the same time that the development of mega palm plantations in Malaysia and Indonesia boomed, the oleochemical industry has been finding itself building capacities after capacities in Southeast Asia (which unfortunately forced many Western producers to close shop and [or] shift into supply partnership instead).

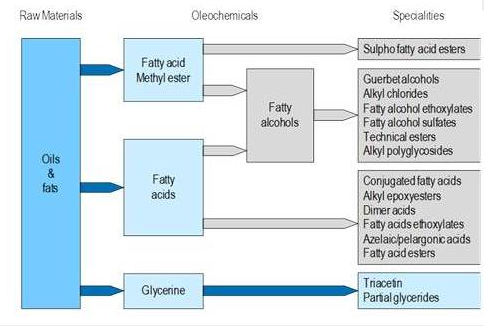

Oleochemical capacity build-up continues in Asia but several Southeast Asian producers have also crossed oceans to set up shop in the West or even expand its portfolio into specialty oleochemicals (base oleochemicals produced are fatty acids, fatty alcohols, esters and glycerin). Here is a flowchart that I got from a Nexant report on oleochemical products coming from fats and oils:

|

| Source: Nexant |

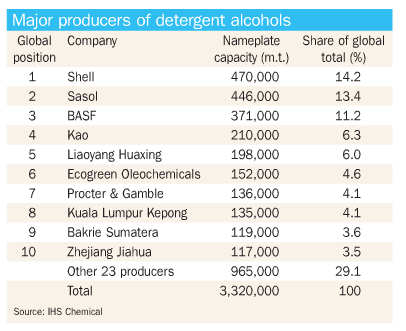

And so we come to the main topic of how the oleochemical industry fared in 2012. As I’ve recently mentioned, capacities continues to build up in Asia especially for fatty alcohols. According to ICIS (subscription required), production capacity of fatty alcohols in Asia may grow by more than 30% this year, which could lead to prospect of fatty alcohol oversupply in the next few years.

Companies expected to start-up new fatty alcohol plant capacities in Asia this year include Musim Mas (Indonesia), Wilmar (Indonesia), China Sanjiang Fine Chemicals (China), Kuala Lumpur Kepong (KLK), and Pilipinas Kao (Philippines). A total of 519,000 tonnes/year capacity is expected to flood the market by the end of this year.

A big chunk of fatty alcohol consumption goes into the production of surfactants. For more on overview of the surfactants market last year, you can read a great blog post about this industry by Neil Burns LLC.

IHS actually just put out today a very informative overview of the detergent alcohols market through the American Cleaning Institute’s newsletter covering their ongoing annual meeting and convention in Orlando, Florida. According to IHS, global demand growth for detergent alcohols will be 3.2%/year between 2012-2017. Consumption will continue to shift to Southeast Asia in line with expectations for regional growth.

According to Kao, demand for fatty alcohols is growing in the Asian region because of a wide range of applications such as use in shampoo and detergent for consumer use, as key materials for surfactants formulated in cleaners for industrial use, and as materials for plastic-processing agents.

Singapore-based Ecogreen Oleochemicals is also expanding its oleochemical capacity in Asia with a 230,000 tonnes/year methyl ester plant and a 180,000 tonnes/year fatty alcohol complex on the company’s current site in Batam, Indonesia. The facility is expected to come on stream by the end of 2014.

Malaysia headquartered Emery Oleochemicals, meanwhile, is keen on expanding in the specialty arena. The company has just commissioned a 10,000-20,000 tonne/year specialty esters plant at its site in Selangor; it is currently building a surfactant plant also in Selangor, which is scheduled to start in 2Q 2013; it is expanding its capacity of oleochemical-based polymer additives production in Loxstedt, Germany, which is scheduled to start by the end of 2013; it is constructing an ethoxylation plant in the Netherlands via a joint venture with Italy’s ERCA Group; and it is building a bio-based polyols facility at its site in Cincinnati, USA, with planned start-up in 4Q 2014.

(Whew!)

In the US, major fatty acid producer Vantage Specialty Chemicals is investing $25m in its Chicago oleochemical site for a kosher glycerine refinery and a new 30m lb/year tallow-based oleic acid production. Production for its kosher glycerine refinery is expected in the second quarter of 2013, while the oleic acid capacity is expected to be on-line by the last quarter of 2013.

Vantage said it has secured a source of kosher crude glycerine through 2021.

“The NAFTA region has historically been supply constrained on kosher glycerine for years and remains a net importer of nearly 200m lbs/year. The new refinery will give customers a much shorter and more reliable supply chain. Demand for tallow-based oleic acid has outgrown the domestic industry’s ability to supply. This expansion will help fill the growing requirement for a number of rapidly expanding markets.” – Vantage Oleochemicals

Singapore-based palm and oleochemical player Wilmar has also been busy going downstream like Emery. Last year, it has partnered with Switzerland-based specialty chemicals company Clariant, for a 50-50 joint venture in producing fatty amines and derivatives.

Amines are commonly used as reactive intermediates for the synthesis of other functional chemicals such as surfactants, detergents, softeners, anti-static agents, bacteriocides, etc., while some amines are also used directly in processes such as in oil drilling, pigment dispersing, anti-caking, rheology modification, etc. (I just took this information from Rhodia’s website by the way… Rhodia is a big fatty amines producer).

Wilmar also has a joint venture with Elevance Renewable Sciences where the companies’ 180,000 tonnes/year biorefinery (using palm oil for feedstock) supposedly should have started late last year. The last news that the blog heard about this biorefinery was in November where according to ICIS (subscription), 80% of the plant’s output will consist of biofuel and the remaining 20% will be bio-olefins (alpha and internal olefins as well as C10 olefins).

Wilmar has also partnered with Amyris in 2011 for the development and commercialization of fermentation-derived surfactants using Amyris’ farnesene molecule. Speaking of surfactants again, in 2011, Wilmar announced that it has partnered with US surfactant producer Huntsman to build a fatty alcohol plant at Huntsman’s chemical site in Rozenburg (Rotterdam, The Netherlands), and to supply natural alcohols to Huntsman. The facility is scheduled to come on stream by 2013.

Another natural fatty alcohol capacity outside Asia supposedly coming onstream late this year is SABIC’s 83,000 tonne/year plant in Al Jubail, Saudi Arabia, via its affiliate Saudi Kayan Petrochemical Company. The fatty alcohol plant will reportedly supply feedstock to SABIC’s downstream ethoxylation plant also in Al Jubail.

See? There are sooo many activities going on in the oleochemicals market it is hard to keep track! And the blog hasn’t even started yet on developments coming from alternative oleochemical production coming from companies such as Codexis, LS9 and Solazyme; increasing new applications for glycerin; and new industrial uses for natural oils aside from production of basic oleochemicals.

Of course, I will be presenting some of those developments at PBIO in March.

According to a recent study by Frost & Sullivan, overcapacity and fluctuating prices of oleochemical feedstock such as tallow, soybean oil, palm/palm kernel oil, coconut oil and rapeseed oil will continue to be two major challenges constraining market growth for oleochemicals.

“Backward integration with plantation or agri-business groups and vertical integration in the value chain across customer product manufacturing companies will help to synergise oleochemical manufacturer’s strengths, enabling them to overcome price fluctuations and remain stable. “Such alliances have been successful for the largest companies in the market, like Emery Oleochemicals group, and could be replicated by other participants.” – Frost & Sullivan

The market research firm estimates revenue earned for oleochemicals in Europe were $3.9bn in 2011, and is projected to reach $4.5bn by 2018 at a growth rate of 2% (2011-2018). In North America, oleochemicals market revenue in 2011 was estimated at $3.53bn and expected to reach $3.91bn in 2018.

According to Transparency Market Research, the global oleochemicals market in 2010 was estimated to be over 13m tons and is expected to reach 15m tons by 2018 at a growth rate of 6% from 2013 to 2018. Asia Pacific reportedly is the fastest growing market for oleochemicals with growth rate of 8.2% (2013-2018) and the region accounted for over 60% of the global capacity in 2011. Europe was the second largest market with 18% share of production.

3 responses to “Oleochemical updates”

Good to see you updates on Oleo chemicals.

Satish Kulkarni

Global Head Marketing Oleochemicals

VVF India Ltd.

Thanks Satish. Feel free to check out our 1st issue of Bio-Materials & Intermediates newsletter. This monthly report will have updates on oleochemicals.

http://us4.campaign-archive1.com/?u=5e75caabe861d02202b577e72&id=cf90824913

Good informations, thanks.