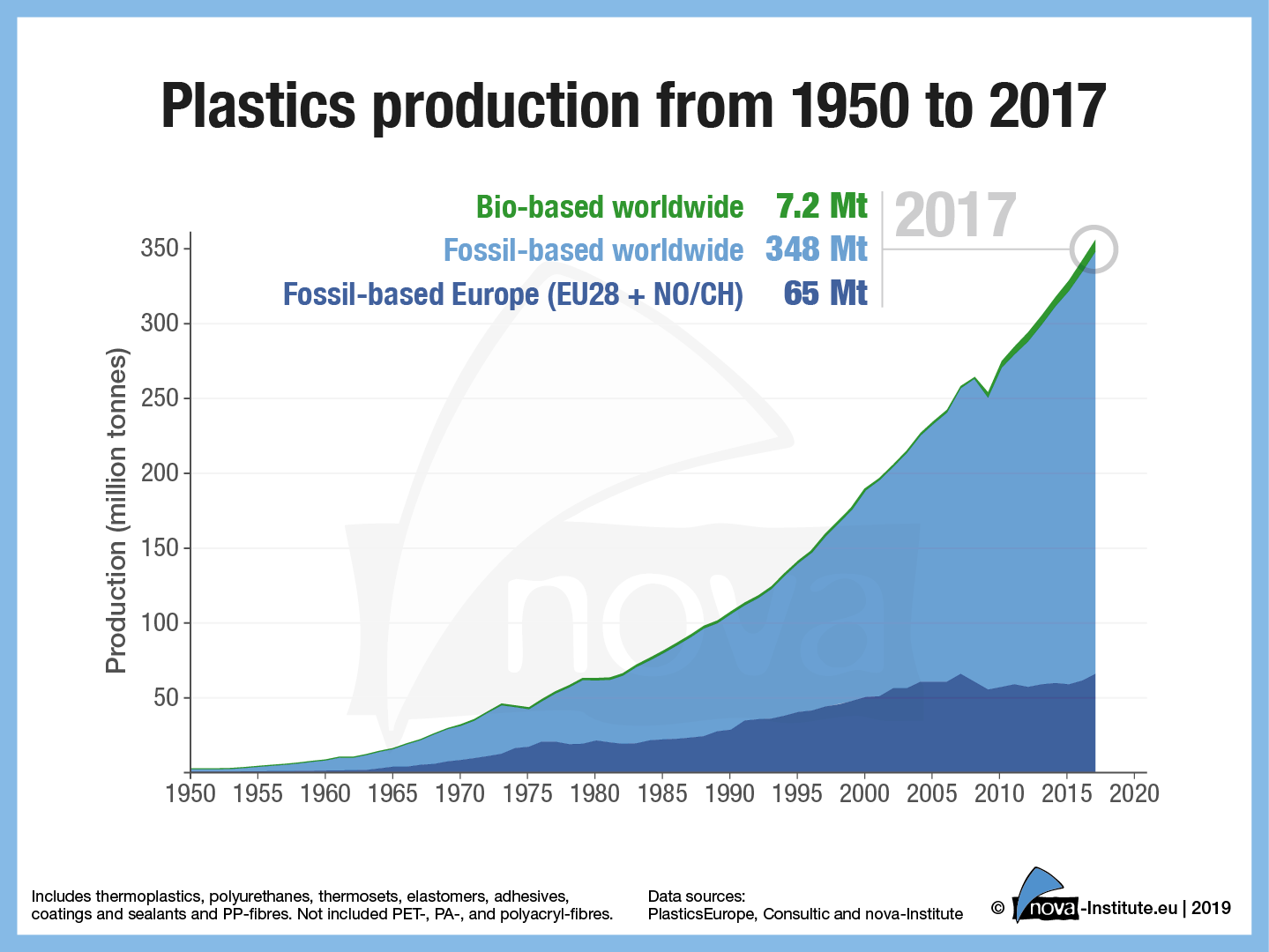

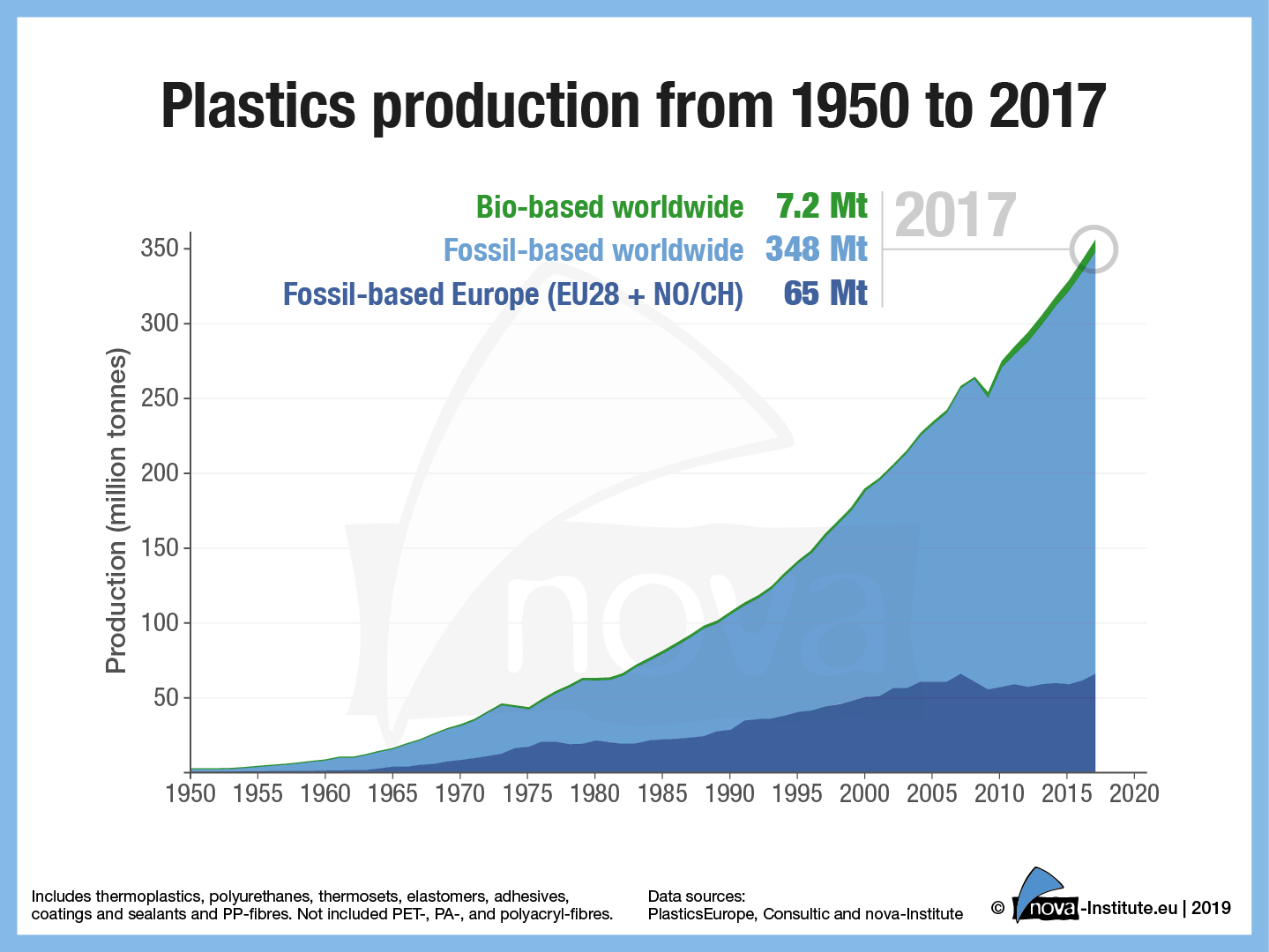

Nova Institute released its latest Biopolymers Summary report for 2018 where Tecnon OrbiChem is a contributor. According to the report, the total 2018 biopolymers production volume reached 7.5 million tonnes – these are already 2% of the production volume of petrochemical polymers. The potential is much higher but is currently hampered by low oil prices and a lack of political support.

The production of bio-based polymers has become much more professional and differentiated in recent years. By now, there is a bio-based alternative for practically every application. The capacities and production of bio-based polymers will continue to grow with an expected CAGR of about 4% until 2023, almost at about the same rate as petrochemical polymers and plastics, therefore, the market share of bio-based polymers in the total polymer and plastics market remains constant at around 2%.

The increase in production capacity is mainly based on the expansion of the polylactic acid (PLA) production in Thailand and the polytrimethylene terephthalate (PTT) and starch blends production expansion in US. Especially PLA and starch blends will continue to grow significantly until 2023. Also, new capacities of bio-based polyamides, polyethylene (PE) and, for the first time, polypropylene (PP) and poly(butylene adipate-co-terephthalate) (PBAT) will also be added in Europe in this period. The great hopeful polyethylene furanoate (PEF) will presumably only be able to offer commercial capacities after 2023.

Besides the leading Asian region which has installed the largest bio-based production capacities worldwide with 53% in 2018, Europe follows with 18% and North and South America with 17% respectively 11%. In the next five years, the share of Europe will rise to 25% until 2023 – all other regions will face decreasing shares. This increase is mainly due to the dedicated bio-based polymers PEF, PHA, PLA and starch blends as well as the new established bio-based production capacity of PP, the increase in PE capacity and an increase in polyamides and PBAT. This shows that the substantial investment in research and development in Europe is bearing fruit. Now, if the political framework were designed more favorably, the bioeconomy in Europe could really flourish.

Consumer goods make up the largest share of actually produced bio-based polymers with 28% in 2018 (mainly PUR, epoxy resins and PA), followed by the building and construction sector (epoxy resins, PA, PUR) with 21%, the automotive and transport sector with 19% (epoxy resins, PA, PUR) and the packaging (flexible and rigid) (PLA, PBAT, PE, PET, starch blends) with 15%, as well as textiles (wovens and non-wovens) (CA, PA, PLA, PTT) with 11%. For 2023, no significant changes are expected with regard to market application shares.

Overall, the market environment remains challenging with low crude oil prices and little political support. The most important market drivers in 2018 were brands that wanted to offer their customers environmentally friendly solutions and critical consumers looking for alternatives to petrochemicals. If bio-based polymers were to be accepted as a solution and promoted in a similar way as biofuels, annual growth rates of 10 to 20% could be expected. The same applies as soon as the price of oil rises significantly. Based on the already existing technical maturity of bio-based polymers, considerable market shares can then be gained.

With regards to bio-based building blocks, the CAGR of 4.5% between 2018 and 2023 will be only slightly higher than that of bio-based polymers (4%) as a whole. The overall production capacity of bio-based building blocks increased by about 5% (120,000 t/a) in 2018, although some pioneers went bankrupt. The overall forecast for bio-based building blocks evolution worldwide indicates a total growth by 4.5% until 2023 with 1,3-propanediol (1,3-PDO), 1,4-butanediol (1,4-BDO), 1,5-pentamethylenediamine (DN5) and 2,5-furandicarboxylic acid (2,5-FDCA) / furan dicarboxylic methyl ester (FDME) being the main drivers.

I will give my annual updates on commercialization of bio-based building blocks at Nova Institute’s incoming International Bio-based Materials conference in May in Cologne. I hope to see you there!