The European Bioplastics‘ annual market data update, compiled in cooperation with the research institutes IfBB – Institute for Bioplastics and Biocomposites (University of Applied Sciences and Arts Hannover, Germany) and nova Institute (Hürth, Germany), reported continued increase in global bioplastics production capacity despite the low oil price environment.

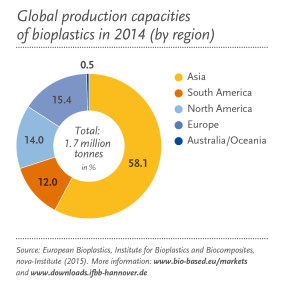

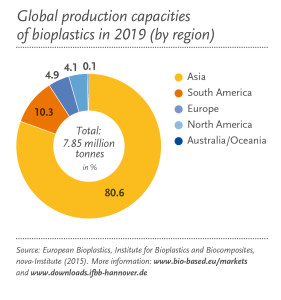

The report noted a projected increase of global capacity from around 1.7 million tonnes in 2014 to approximately 7.8 million tonnes in 2019. Biobased, non-biodegradable plastics, such as biobased PE and biobased PET, are the main drivers of this growth. More than 60 percent of the bioplastics production capacity worldwide in 2014 was biobased, durable plastics. This share will increase to over 80% in 2019.

Production capacities of biodegradable plastics, such as PLA, PHA, and starch blends, are also growing steadily, nearly doubling from 0.7 million tonnes in 2014 to well over 1.2 million tonnes in 2019. PHA production will double by 2019 compared to 2014, due to a ramp-up of old and new capacities in Asia and the USA. Compostable plastics are said to be moving from niche to mainstream and many compostable plastics have found their true added value applications.

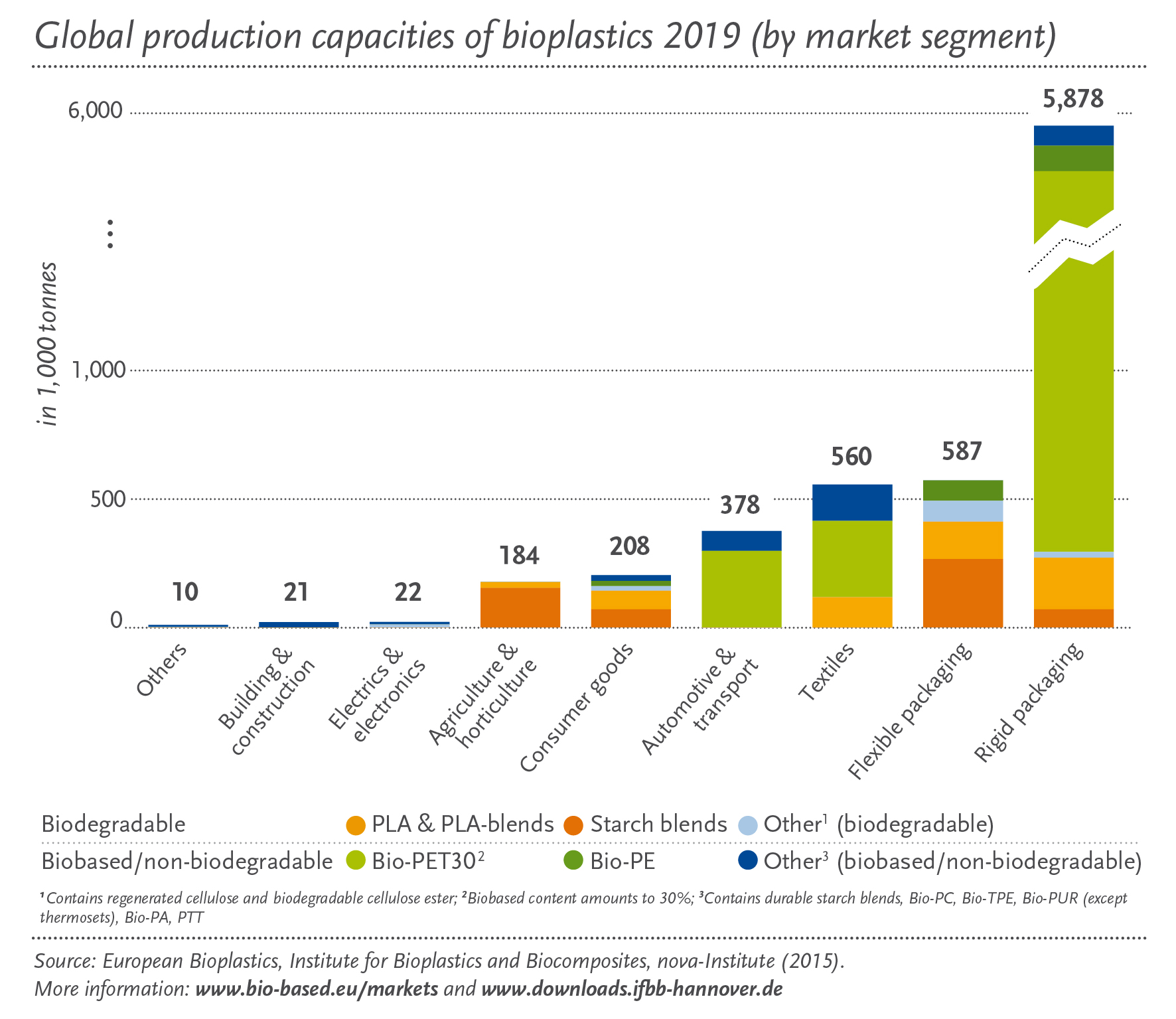

Packaging remains the single largest field of application for bioplastics with almost 70% (1.2 million tonnes) of the total bioplastics market. Due to the excellent fit of bioplastics in the packaging market, this number is expected to increase to more than 80% (6.5 million tonnes) in 2019 driven by a growing consumer demand for products with a reduced environmental impact.

The data also confirms a decisive increase in the uptake of bioplastics materials in many other sectors, including textiles, automotive applications, and consumer goods. The land used to grow the renewable feedstock for the production of bioplastics amounted to approximately 0.68 million hectares in 2014, which accounted for only 0.01% of the global agricultural area of 5 billion hectares, 97% of which were used for pasture, feed, food, other material uses, bioenergy, and biofuels. This clearly shows that there is no competition between the renewable feedstock for food, feed, and the production of bioplastics.

With a view to regional capacity development, Asia will further expand its role as major production hub. In 2019, more than 80% of bioplastics will be produced in Asia. Europe will be left with less then 5% of the production capacities. Whereas countries such as the USA, Asia, and Latin America are implementing close-to-market measures to attract production hubs and promote faster market development, the European market for bioplastics is reportedly limited by the lack of economic and policy measures to allow for a larger scale-up of production capacities within Europe.

At the recently held 10th European Bioplastics Conference that took place in Berlin, presentations from big brands and retailers such as IKEA and Marks & Spenser, reportedly outline their commitments and initiatives to become more sustainable, with the role of bioplastics achieving some of these ambitious goals. IKEA noted that it aims to make its plastics 100% renewable and recycled sources by 2020.