I have been loosely following environmental issues concerning the sustainability of global palm oil supply and production given my interest in the oleochemical sector where palm oil derivatives is a major feedstock.

Japan-based fragrance company Shiseido was just one of the latest global consumer/food product firms that announced their initiative to make sure their palm oil supply comes from a sustainable supply chain.

Shiseido has already joined the Roundtable on Sustainable Palm Oil (RSPO) since 2010. RSPO is an international non-profit organization established by the World Wide Fund (WWF), companies and organizations involved with palm oil production. According to RSPO, total members as of October 23 was 755.

Shiseido said it will make sure its total volume of palm oil used as raw material for their cosmetic products will be RSPO-certified oil by 2013. All RSPO members are required to submit a time bound plan to produce, trade, process and/or purchase and use 100% certified sustainable palm oil before their general assembly meeting which was held in November 1 (somewhere…).

Some of the companies who announced intention to RSPO-certify their palm oil supply includes Henkel, SC Johnson, Procter & Gamble (P&G), Cargill, Unilever, Kellog, Nestle and General Mills, among others.

Henkel started purchasing certificates for sustainable palm oil starting January this year and onwards for its entire range of laundry and home care products. The company said it has started to cover its overall product portfolio since 2009 and plans to complete certification of all of its palm oil supply by 2015.

Beyond RSPO, Henkel said it has been working with the trading platform GreenPalm, which initiated the certificate trading system for palm kernel oil and was the first company in the world to purchase palm kernel oil certificates in 2008.

SC Johnson is also targeting 2015 to complete certification of all of its palm-oil based ingredients, which it uses in small amounts for its home cleaning products and some of its air care products. The same timeline is expected for P&G where it intends to purchase and use only sustainably-sourced palm oil by 2015.

Unilever, which claimed to be one of the world’s largest buyers of palm oil with a purchase of 1.2m tonnes/year (about 3% of the world’s total production), noted that it expects to have 100% of its palm oil purchases come from sustainable sources by the end of this year, 3 years ahead of its schedule.

Last year, 64% of the company’s palm oil purchases were reportedly from sustainable sources and was bought in the form of GreenPalm certificates. Unilever claimed to be the biggest single buyer of these certificates (which conforms to the standards of the RSPO) worldwide.

Here’s how GreenPalm works according to Unilever:

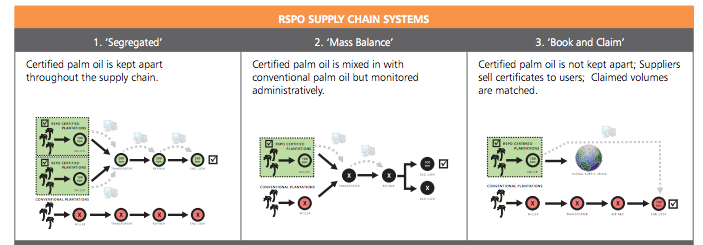

The GreenPalm system enables RSPO-certified palm oil producers to register a quantity of their output with GreenPalm. Growers are awarded a GreenPalm certificate for each tonne of palm oil which has been sustainably produced and can sell the certificates via the GreenPalm trading system. This enables buyers to claim that they have supported the sustainable production of palm oil. The palm oil itself is sold, processed and purchased in the usual, non-segregated way.

All the palm oil that goes into our factories in Europe and the Americas is covered by GreenPalm certificates, as is the oil used in our Australasian, Malaysian and Indonesian operations.

Unilever is also in discussion with the Indonesian government about investing over EUR100m in a large processing plant for palm oil derivatives in Sumatra, which Unilever said will make it easier to trace the source of palm oil they used as well as cut back their transport expenses.

If the blog is not mistaken, all of the GreenPalm certificated oil is purchased at a premium to the market price for ordinary palm oil. Looking at GreenPalm’s website. The last price of palm oil certificates was traded at $1.90 and palm kernel oil (PKO) at $6.

In 2009, Unilever has suspended one of its Indonesian palm oil supplier, PT Smart owned by Sinar Mas Group, after environmental group Greenpeace wrote a report that the company has been engaging in illegal deforestation and peatland clearance in Indonesia. Agribusiness firm Cargill and food company Nestle also suspended Sinar Mas as their supplier.

Up until now, Unilever is still monitoring if Sinar Mas although the palm producer claimed that it is cleaning up its act. Nestle said it has resumed its palm oil purchases from the company as last year, Golden Agri-Resources (the oil palm holding company of Sinar Mas) announced that some of their palm plantations and mills in North Sumatra under PT Smart are now RSPO-certified.

By the way, Unilever is also involved in the Roundtable on Responsible Soy (RTRS) but that is another story to tell…

Unilever has also partnered with Cargill since 2010 for RSPO-certified palm oil supply for Unilever’s European operations. Last year, Unilever brought 27,000 tonnes of segregated palm oil into Europe. Cargill has been busy since 2010 promoting its RSPO-certified palm oil supply capability and started offering the products to North American food manufacturers since July last year.

Food firms are all in

Cargill said its palm plantation PT Hindoli in Sumatra, Indonesia, was one of the first 15 plantation owners in the region to receive RSPO certification in 2009.Cargill plans to cover 100% of its palm oil products and all of its customers worldwide including China and India by 2020.

Cargill said its palm plantation PT Hindoli in Sumatra, Indonesia, was one of the first 15 plantation owners in the region to receive RSPO certification in 2009.Cargill plans to cover 100% of its palm oil products and all of its customers worldwide including China and India by 2020.Hopefully, Cargill and other RSPO-certified palm oil distributors will diligently cover their supply chain as according to this July 2012 article from environmental group Rainforest Action Network, Cargill is not transparent with their own palm plantation sources and the group accused Cargill of doing business with plantation owner PT Best, which is under controversy with respect to their plantation operations.

Cargill owns and operates only two oil palm plantations in Indonesia at the moment – PT Hindoli and PT Harapan Sawit Lestari on the island of Borneo in West Kalimantan. In fact, RSPO certification could be a booming business for agribusiness firms given the premiums for these oils. Another US agribusiness firm Bunge, has entered the palm oil plantation industry late last year with a joint venture with PT Bumiraya Investindo (BRI).

Bunge has acquired a 35% minority stake in BRI for an undisclosed sum. Bunge said the investment represents a first step in building its upstream presence in palm oil. BRI owns land banks in Sumatra and Kalimantan and operates four plantations in Kalimantan. It is also constructing a crude palm oil mill in Kalimantan.

The blog already mentioned Nestle which noted that by the end of 2012, it will achieve a total of 80% RSPO certified sustainable palm oil (including 67% in the form of GreenPalm certificates). By 2013, the company hopes to achieve 100% RSPO certified palm oil, two years ahead of its commitment.

Kellogg has been purchasing GreenPalm certificates for its palm oil use although the company did not committed to any timeline for covering 100% of its palm oil use until segregated palm oil supply will be available for the company. Kellogg has begun using this year segregated supply of sustainably grown palm oil in the EU.

By the way, palm products distributor IOI-Loders Croklaan is one of the first to offer RSPO certified segregated palm oil in continental Europe on a large scale. The company is also shipping segregated oil here in the US since February last year.

In 2010, General Mills also put out a timeline that it will try to source 100% of its palm oil from sustainable supply chain by 2015. The blog did not get any other recent information on General Mills’ milestones in sustainable palm oil purchase probably because the company claimed it is not really a big buyer of palm products.

Now it’s all great that multinational firms are all on board in protecting the rainforests in Indonesia and Malaysia against unsustainable expansion of palm plantations in the region. However, given that palm oil demand continues to grow worldwide, the dilemma is whether the industry can deliver sustainably-sourced palm oil enough to satisfy demand from food, cosmetics, chemicals, and other industries that use this ubiquitous product.

As of September 2012, annual production capacity of certified sustainable palm oil (CSPO) to date was around 7.16m tonnes compared to 5.6m tonnes a year ago. This accounts for only 12% over global palm oil production, according to RSPO. Remember that a lot of companies are hoping to cover 100% of their purchase with sustainably-sourced product by 2015.

In fact, our twitter friend Lucia sent the blog this document from the UK’s Department for Environment, Food and Rural Affairs (DEFRA), which stated the country’s intention to achieve 100% sourcing of “credibly certified” sustainable palm oil by the end of 2015. The commitment covers the use of both palm oil and PKO.

Annual production capacity of PKO as of September 2012 was 1.76m tonnes compared to 1.3m tonnes a year ago, according to RSPO.

As Lucia said, it is doubtful that UK could achieve such commitment. And as we emphasized the word “credibly certified,” there are actually government schemes coming from Malaysia and Indonesia to have their own palm oil certifications. Maybe this could help speed up sourcing for more sustainable palm products but buyers still have to do diligence in covering their supply chain all the way upstream even after acquiring such certifications.

2 responses to “Sustainable Palm oil: Is certification enough?”

A very comprehensive piece on a complex issue.

Taking in concern the environmental factors, Certification is a need. Many chemical products are heavily used, so the certification for Chemical product should be genuine. Know if Your product requires REACH certification.