Synthetic biology company Ginkgo Bioworks announced today that it plans to acquire Zymergen in an all-stock transaction valued at $300 million in market capitalisation. Zymergen stockholders will receive a fixed exchange ratio of 0.9179 Ginkgo shares for each Zymergen share, representing 5.25% pro forma ownership of Ginkgo following the transaction. The agreement represents Ginkgo’s largest acquisition to date.

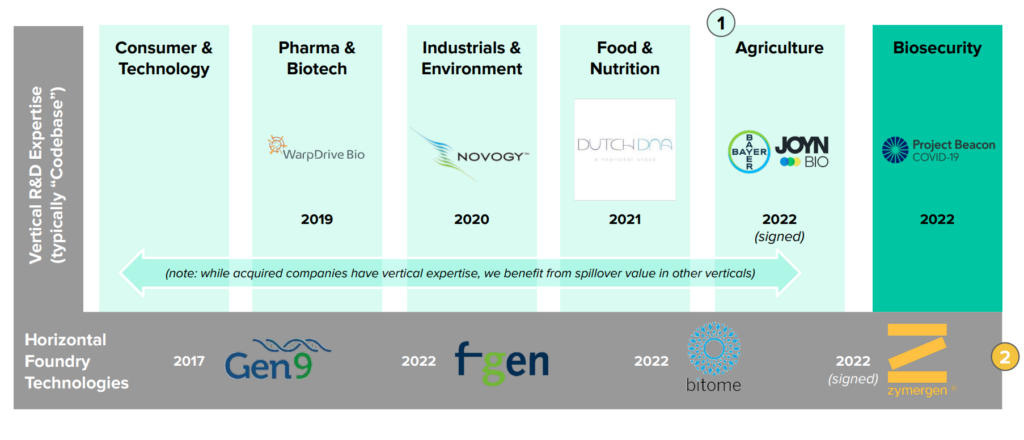

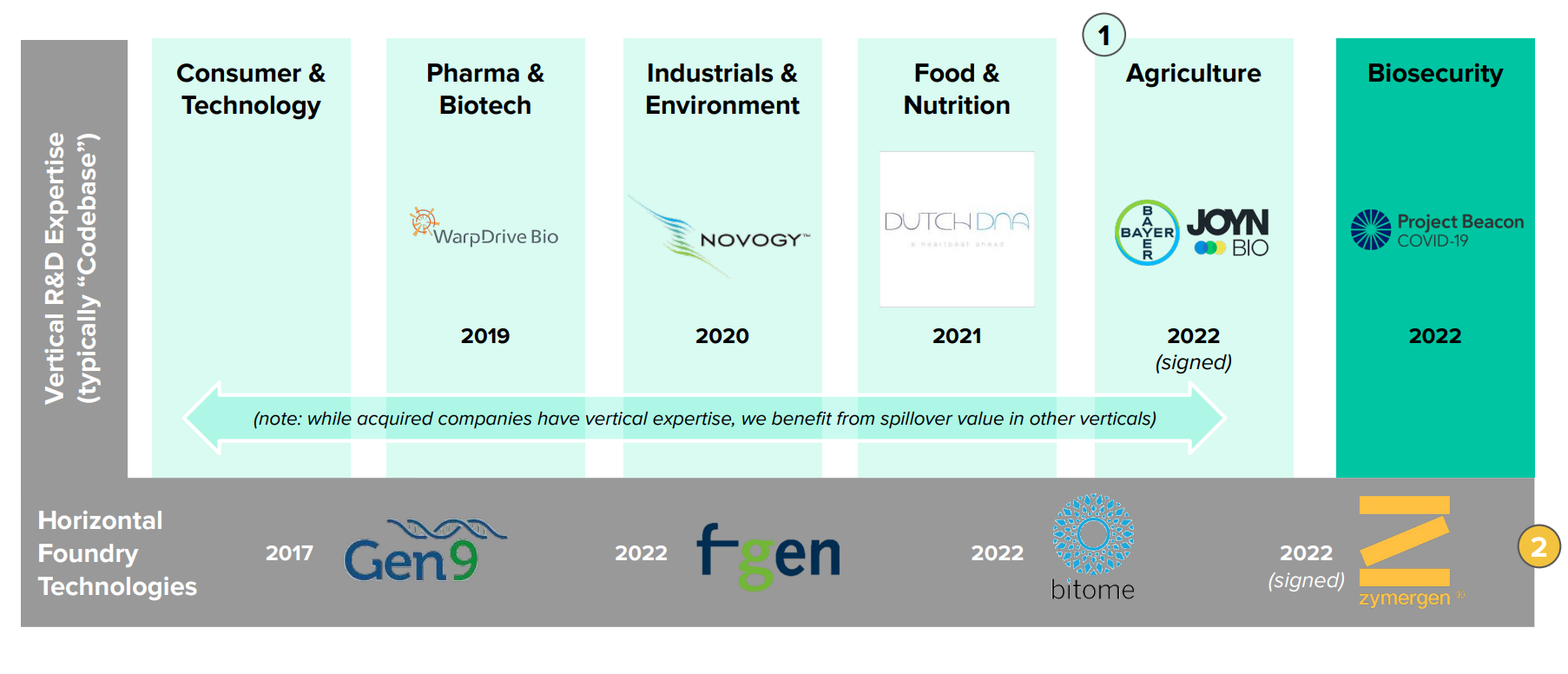

Ginkgo plans to integrate Zymergen’s core automation and software technologies for scaling strain engineering capacity into its Foundry, including Zymergen’s machine learning and data science tools for exploring known and unknown genetic design space. Ginkgo said its customers will also benefit from the expansion of Ginkgo’s library of biological assets (“Codebase”) following the transaction. This transaction brings together two highly complementary organizations that share the vision that biology can transform a wide range of industries, including manufacturing, agriculture, and medicine.

Zymergen will continue its standalone cost restructuring initiatives, including headcount reductions and program rationalization. Finally, adding Zymergen personnel is expected to help fill planned hiring by Ginkgo as it scales the platform. The transaction is expected to be completed by the first quarter of 2023, subject to approval by Zymergen’s stockholders, receipt of regulatory approvals, and satisfaction or waiver of other closing conditions

Ginkgo says its balance sheet of around $1.5bn (as of 3/31/2022) allows the company to be opportunistic in the current market environment while still maintaining a healthy margin of safety. Many companies are reportedly facing valuation and/or liquidity concerns and are open to exploring strategic alternatives.

We reported about Zymergen’s IPO last year, including the commercialization of its first potential biomolecule Hyaline. The Polymerist wrote a very interesting analysis about Zymergen in August 2021 and why the company’s stock price plummeted last year.

In separate news, Ginkgo Bioworks also announced today that it has acquired Bayer’s West Sacramento Biologics Research & Development site, team and internal discovery and lead optimisation platform for $83 million in consideration. This transaction was a follow-up in April when the companies first announced Ginkgo’s plan to expand its agricultural biologicals platform capabilities with the acquisition of Bayer’s West Sacramento 175,000 sq. ft. site.

Ginkgo will also integrate the R&D platform assets from Joyn Bio, a JV between Ginkgo and Leaps by Bayer formed in 2017. Bayer will be the first major partner of Ginkgo’s expanded agricultural biologicals platform entering into a new collaboration focused on the advancement of Joyn’s marquee nitrogen fixation program as well as new programs in areas such as crop protection and carbon sequestration. As part of a three-year strategic partnership, Ginkgo will provide research services to Bayer in the field of agricultural biologicals with the potential to earn downstream value in the form of royalties on net sales from products developed under the partnership.

Early this month, Ginkgo also launches a new cell programming project as part of a broader collaboration with Sumitomo Chemical, one of Japan’s leading chemical companies. Through this partnership, Sumitomo Chemical will leverage Ginkgo’s extensive codebase and expertise in organism engineering to produce molecules in a sustainable fashion that are used in products across a broad range of industries. The target molecule of this latest project is planned to be used in the personal care and cosmetic industries and is envisioned to augment or replace one that is otherwise currently gathered from animal sources.

This is a new project in addition to the companies’ existing collaboration, which began in 2021 and focuses on bio-based production of selected molecules for the broad Sumitomo Chemical portfolio, which includes offerings from personal care and cosmetics to agriculture and pharma, and from chemicals to industrial products and more. Sumitomo says the cell programming project will enable Sumitomo to build its own capability on fermentation production with the active involvement of its new organization SynBio Hub in the USA.

One response to “Ginkgo on a buying spree, acquires Zymergen”

This must be a sobering moment for anyone working on biopolymers, biomaterials, etc. This company raised so much money and hired a huge team but was unable to make a new material that any customer wants.