International Flavors and Fragrances (IFF) announced yesterday its acquisition of DuPont’s Nutrition and Biosciences (N&B) business in a Reverse Morris Trust Transaction*. The deal values the combined company at $45.4 billion on an enterprise value basis, reflecting a value of $26.2 billion for the N&B business based on IFF’s share price as of 13 December 2019. Upon completion of the transaction, DuPont will receive a one-time $7.3 billion special cash payment subject to certain adjustments.

*A Reverse Morris Trust in United States law is a transaction that combines a divisive reorganization (spin-off) with an acquisitive reorganization (statutory merger) to allow a tax-free transfer (in the guise of a merger) of a subsidiary.

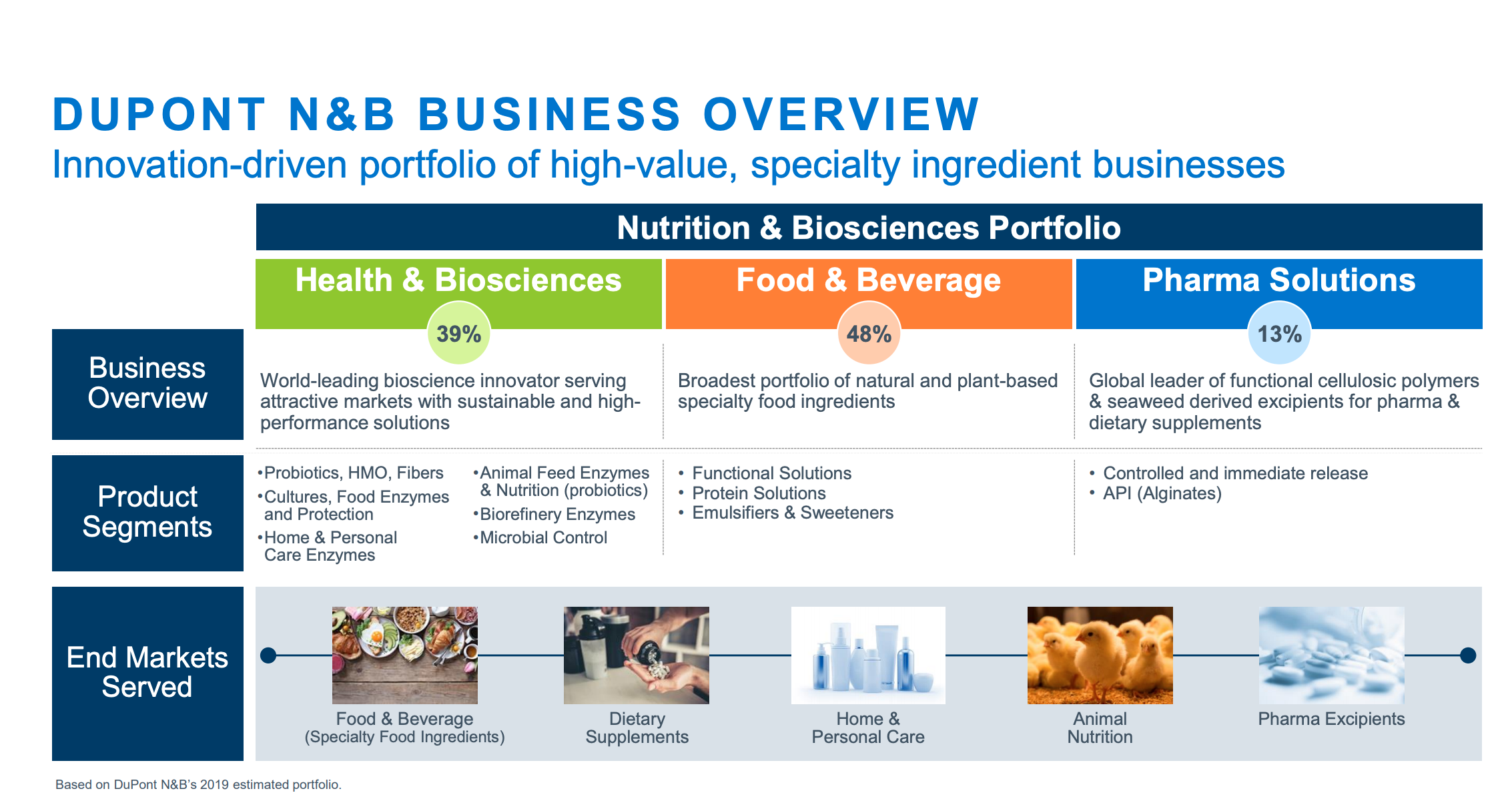

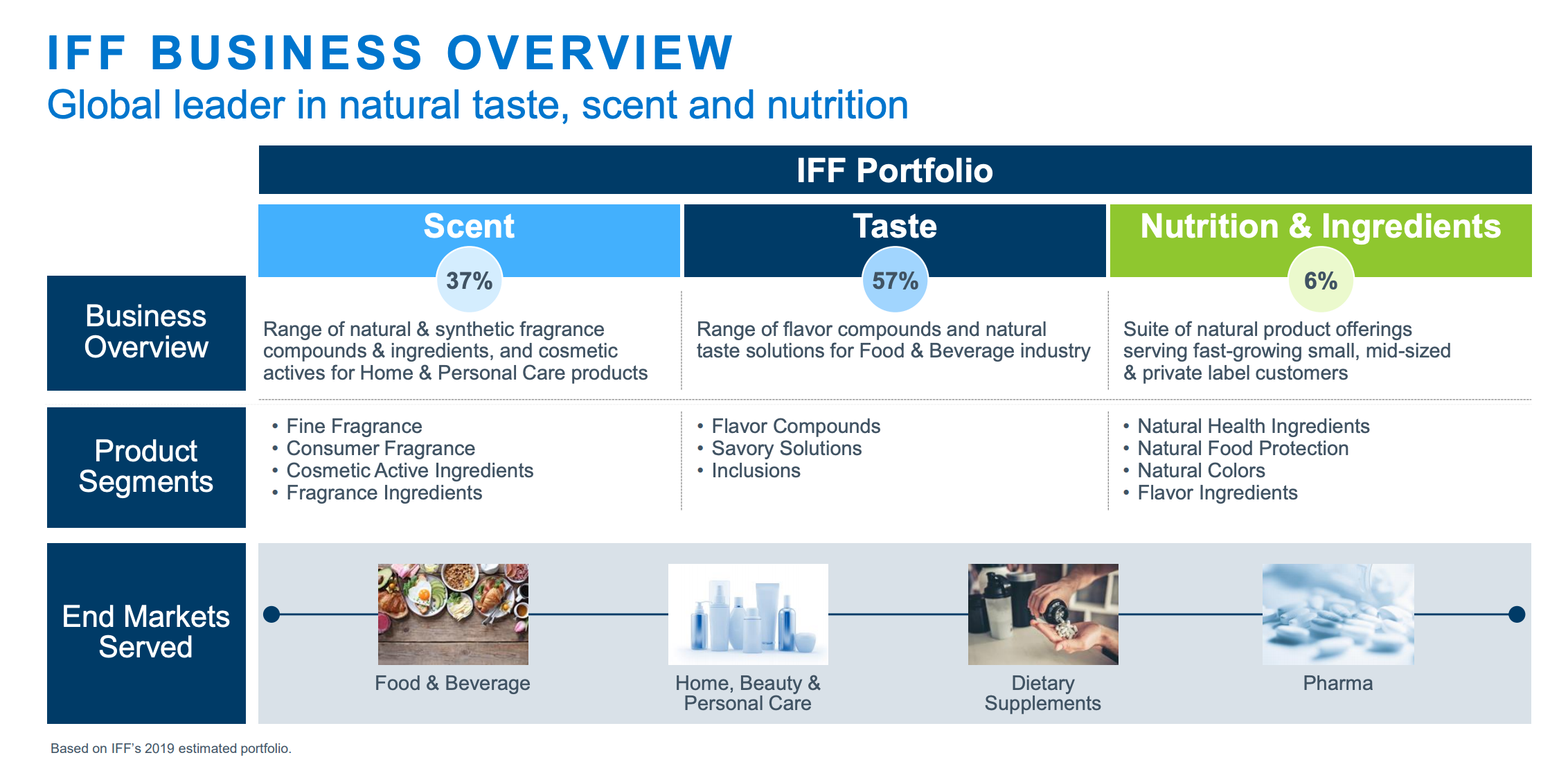

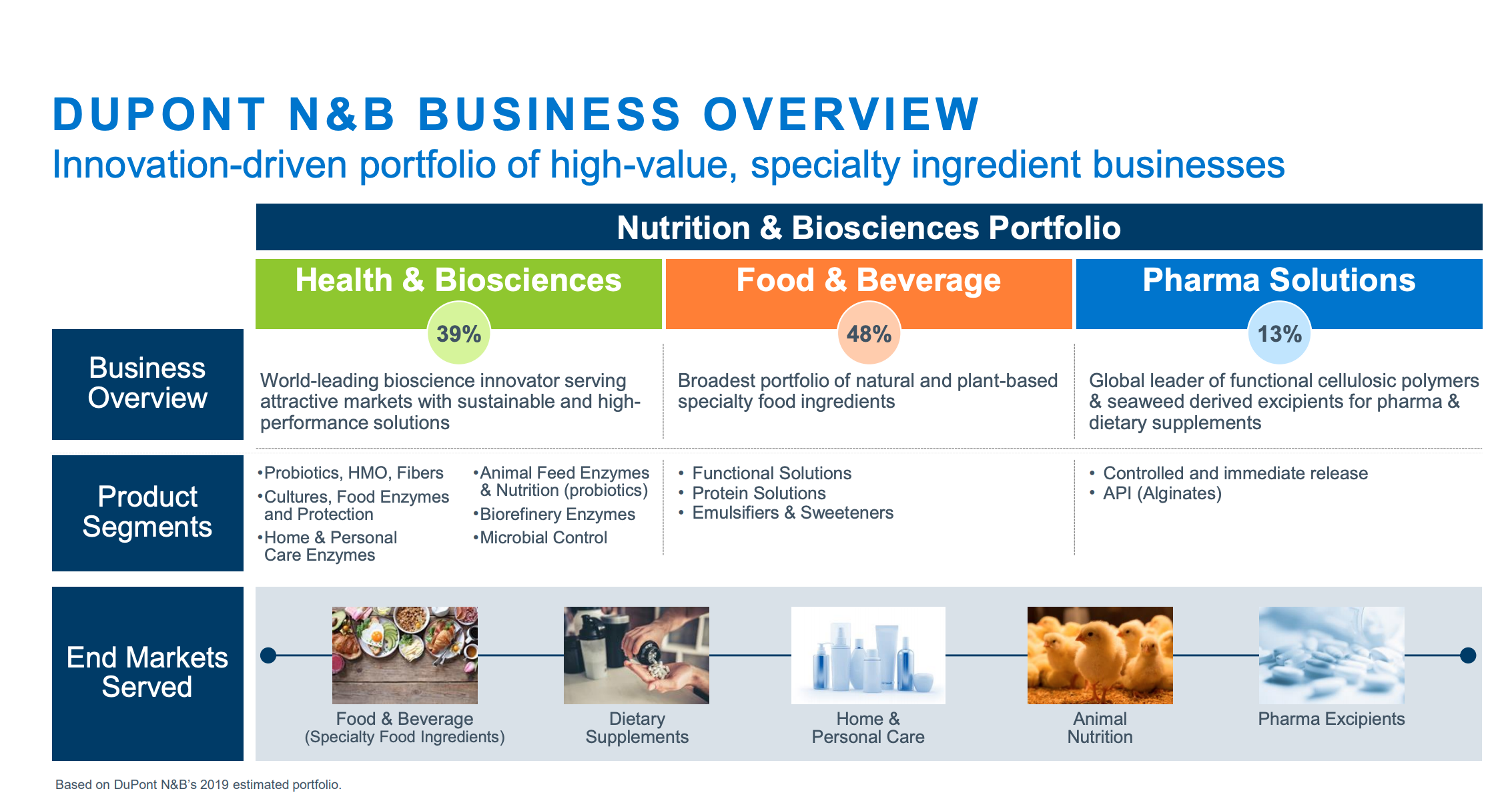

The combined businesses will reportedly create a global leader in high-value ingredients for food and beverage, home and personal care, and health and wellness markets with estimated 2019 pro forma revenue of more than $11 billion, and EBITDA of $2.6 billion excluding synergies. IFF will expand its portfolio with nutrition, enzymes, cultures, soy proteins and probiotics categories.

IFF expects to realize cost synergies of around $300 million on a run-rate basis by the end of the third year post-closing. The combined company’s target is to deliver more than $400 million in run-rate revenue synergies, which would result in more than $175 million of EBITDA, driven by cross-selling opportunities and leveraging the expanded capabilities across a broader customer base.

DuPont’s original businesses are slowly being peeled away post-Dow/DuPont merger. One wonders when and where the company’s Biomaterials business will land next.

By the way, I just wrote a report on the market for plant-based proteins in Tecnon OrbiChem’s recent Biomaterials issue. The agribusiness industry has been very active in this space and I’m sure we’ll be seeing the new IFF entering the market soon.