Good news! I will be attending the American Chemical Society Green Chemistry Initiative (ACS GCI) 18th Annual Green Chemistry & Engineering Conference (whew, that’s a mouthful!), which will be held on June 17-19 in Bethesda, Maryland. This is my first time attending this conference so I’m excited to cover it live via Twitter. Follow @DGreenblogger or @ACSGCI at #GreenChemistry

Here’s another good news from the renewables industry.

Solazyme, with its joint venture with Bunge Global Innovation LLC, has finally started the Solazyme Bunge Renewable Oils plant in Moema, Brazil, and announced the successful production of its first commercially saleable products on full-scale production lines, including a 625,000L fermentation tanks. Both oil and encapsulated lubricant, Encapso™, products have been manufactured; production is continuing and is expected to reach nameplate capacity of 100 ktpa within the next 12-18 months.

Solazyme said it is now manufacturing products at three large scale facilities, including its 2 ktpa integrated facility in Peoria, the 20 ktpa Iowa facilities in Clinton/Galva, and the 100 ktpa facility in Brazil.

As I’ve mentioned before, I have been covering the oleochemicals market for more than a decade now, and Solazyme’s algal oils could compete in certain markets where the use of traditional vegetable oils and fats command premiums. One example is high oleic oils which is being used in the food and lubricants industry. One industry observer noted to the blog that the lubricants market usually pays top-notch dollars for their raw materials. The same goes for the cosmetics and personal care market.

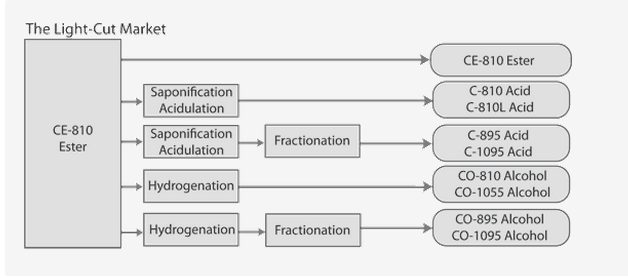

I have been reporting some of the current trends within the oleochemical industry in Tecnon OrbiChem’s monthly Bio-Materials newsletter. One of them is that the oleochemicals industry is currently paying gold — not literally but close enough, for the light cut C8 fatty acid, caprylic acid, which is largely being used in the manufacture of lubricant esters, in medium chain triglycerides (MCTs) used in food and pharmaceuticals, as a cosmetic ingredient, in PVC stabilizers, perfume and fungicides.

Caprylic acid can also be converted into capryl alcohol, which is used in the manufacturing of esters for flavors and fragrances.

Caprylic acid is currently commanding almost $5000/ton in value in Southeast Asia. The C8 cut is produced from the fractionation of coconut (7.8% out of the total fatty acid content) and palm kernel oil (3.3%). The problem with C8 supply is that it can only be sourced from these oils, and you have to have big enough demand for C12-C14 mid-cuts, which accounts for the largest fatty acid components in coconut and palm kernel oil, in order for fatty acid manufacturers to justify producing the co-product C8-10 fatty acid chain.

The beauty of the Solazyme algal oils is that they can tailor the fatty acid content of their oils based on the current demand of customers. Another example is high erucic rapeseed acid oils, which the blog posted last year.

The problem is, 122 ktpa, is not enough volume for now for the company to supply the needs of the oleochemical industry. The annual fatty acid capacity in Asia is pegged at around 4-5 million tons. Although not all fatty acid companies produces the C8-10 fatty acid chain, the required oils to produce this chain is probably much more than what Solazyme’s current total capacity can handle.

One response to “Solazyme Begins Commercial Production in Brazil”

Agreed, C8 caprylic acid and derivatives of, surfactants, some solvents etc Are always at a premium to longer chained oils. This usually means they are only used in high performance applications, or where price is not as important. However if the price could be reduced there would be many applications which a C8 would be preferable over C10-C12 chain lengths. Hence global demand increase could also possibly surface from such an effect.